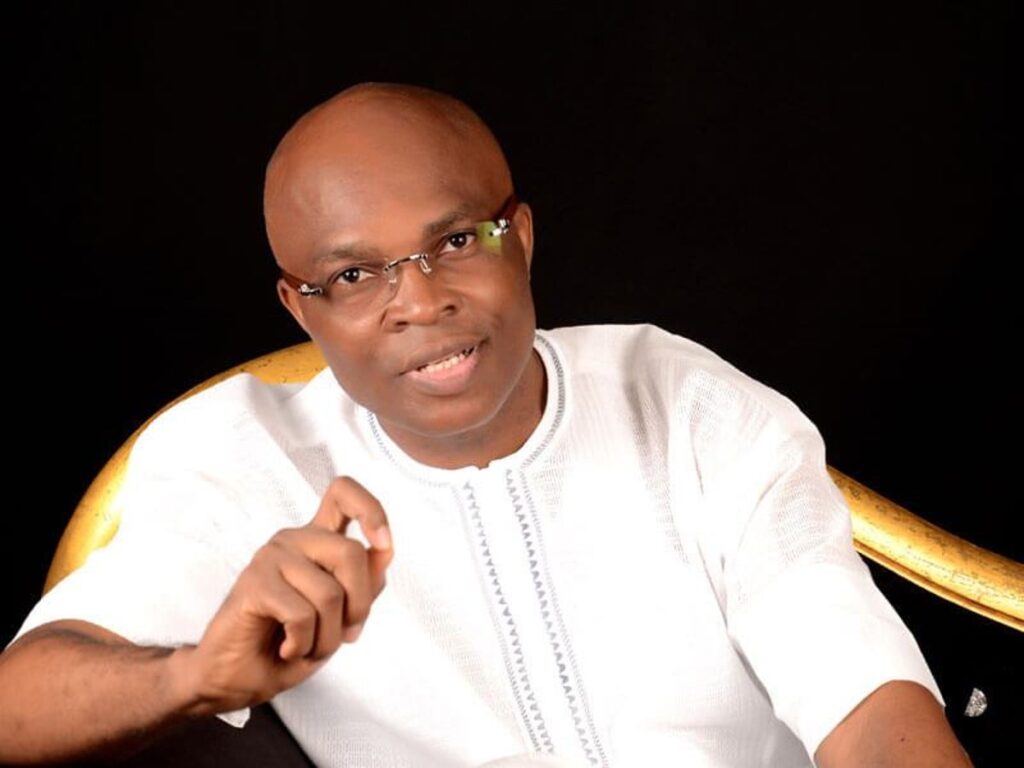

Jeremy Awori is the current Chief Executive Officer of Ecobank Transnational Incorporated (ETI) With over twenty-five-years of experience in the banking industry, Awori, in this interview with HELEN OJI, spoke on the bank’s Growth Transformation Returns (GTR) strategy, as a key driver for its growth ambitions, the future of financial services on the continent and other sundary issues

Ecobank Group, Access Bank Group, UBA Group and two others entered into an agreement with the Pan-African Payment and Settlement System (PAPSS) to revolutionise the settlement of cross-border transactions across Africa, leveraging the vast network of subsidiaries. How has the journey been so far?

Very encouraging and exciting. To provide some context, PAPSS should save Africa $5 billion in payment transaction costs every year, when fully operational. The philosophy behind PAPSS very much aligns with Ecobank’s founding principles, specifically to boost intra-African trade through financial and economic integration.

As you are aware, Ecobank has the widest geographical footprint on the continent, with its presence in 35 African countries.We have an unrivalled and scalable digital payment ecosystem across the continent. Our collaboration with PAPSS is driven primarily by our desire to make available the payment infrastructure that will make the African Continental Free Trade Area (AfCFTA) a reality. This collaboration effectively accelerates the impact and reach of PAPSS.

Following a successful pilot scheme in Ghana in 2022, Ecobank, in accordance with the terms of the Agreement with PAPSS, serves as an inter-bank settlement agent on behalf of Central Banks, in our operating countries, which have not yet onboarded to PAPSS.

Six Ecobank affiliates in Gambia, Ghana, Guinea, Liberia, Nigeria, and Sierra Leone, have signed on to implement PAPSS.

This is just the beginning; we are extending PAPSS to our digital channels and encouraging fintechs within our ecosystem to also participate.

How has your Growth, Transformation and Returns (GTR) strategy agenda advanced your consumer and commercial banking business, especially in the areas of payments, remittances and Fintech?

Our Growth Transformation Returns (GTR) strategy is a key driver for our growth ambitions. While the strategy has multiple components, two of its main objectives are to accelerate the growth of our consumer banking and commercial Banking businesses.

Furthermore, recognising the growing needs of a digitally savvy and increasingly connected Africa, we have responded by consolidating, under the strategy, our payments, remittances and fintech businesses into one vertical for structured focus and to maximize growth opportunities. At the Ecobank Group, we are bullish on multiple fronts about the future of financial services on the continent.

The thriving youth population is driving a revolution of innovation and a related significant and growing appetite for smartphones. Africa’s huge percentage of cash-based transactions and unbanked population, though usually highlighted as a negative, for us signifies immense responsibility and opportunity to roll up our sleeves, get to work, and change the narrative. Today, as observed by the World Economic Forum, MSMEs account for at least 95 per cent of all registered businesses in Africa and contribute about 50 per cent of GDP.

These MSMEs form the bedrock of employment generation, intra-African trade under the AfCFTA, and economic growth. As we enhance the speed, scope and quality of financial services to these MSMEs, we drive growth in Africa.

There is a gender dimension to this that should not be overlooked. About 58-60 per cent of MSMEs in Africa are owned by women.Enabling financial services to MSMEs in Africa empowers our women, particularly when we are purposeful in the design and delivery. It is for this reason that the Ecobank Group developed its Ellevate Program for women led/owned businesses.

As we invest in our youth, and generations of Africa’s youth enter the workforce or become the entrepreneurs of tomorrow, Africa, more than any continent, has a distinct human capital led growth opportunity. We recognize that and are positioned to help realize that future.

Needless to say, we are determined to grasp these opportunities to grow our Consumer and Commercial banking business verticals, as well as our new Payments vertical.

With our unrivalled payment ecosystem and one central technology for payments and collections, we will be there to onboard the trader, enable the transformation of their business as they are guided to embrace ecommerce and expand their market and range of goods, safe in the knowledge that they will receive payments digitally using our wide range of digital solutions.

With our digital solutions made for SMEs, traders are able to grow their businesses and extend their coverage beyond one country by connecting with importers or exporters through the Ecobank Single Market Trade Hub.

Innovation remains a key business driver, and in this regard, we are recognised for our steadfast support to fintechs through our annual Fintech Challenge and our Banking Sandbox which enables fintechs to test and develop solutions using Ecobank APIs. We aim to facilitate the next generation of fintechs and NeoBanks for Africa.

How does the Group intend to support its Nigerian business to ensure consistent returns to shareholders?

Nigeria is both Africa’s largest economy and the most populated, with the population forecast to grow by 72 per cent to 377 million by 2050. This illustrates why Nigeria is a vital market for us and the massive growth potential that it offers.

Though the country, in recent times, is experiencing macro-economic challenges, we recognize the sheer force of the innovation, talent and commerce coming out of Nigeria requiring financial services. We further recognize that these will be critical to achieving the economic turnaround that is desired.

At Ecobank, we are intensely focused on the turnaround of our business in Nigeria, increasing our efforts to scale its performance and build a strong brand in the country.

We are focused on offering best in class financial services to our customers, leveraging our Pan African strengths to deepen trade and remittances across Africa, and progressively grow our service offering and relevance in Nigeria for profitability and positive social impact.

We have identified gaps in financial services in the market, which we intend to address to enable our clients and customers to realize their ambitions.

In your third quarter operation, the bank achieved growth in its gross earnings by 59 per cent while profit rose by 56 per cent. How do you intend to consolidate on the performance sir?

Ecobank’s strong results for the nine months to 30 September 2023 reflect the resilience of our diversified business model and positive operating leverage delivering strong revenue growth of 34 per cent in constant currency and an improved cost-to-income ratio of 53.7 per cent. These results were achieved despite the challenging macroeconomic environment – both globally and in Africa.

Our strong performance will be further enhanced by our newly launched Growth, Transformation and Returns (GTR) strategy, which will focus on delivering great products and services, accelerate the growth of our consumer banking and commercial banking business verticals, and diversify and grow revenue streams of our market-leading corporate and investment banking business.

We will further scale our payments, remittances and fintech business, while entrenching our leadership positions in markets where we are a top three bank and addressing our subscale markets.

We will continue to invest in technology, in all its forms, to provide better, faster, and easier services to our customers. Our new brand campaign – ‘A Better Way | A Better Africa’ – helps to create greater connection with our clients and customers and support our growth businesses.

The brand reflects our three foundational pillars, our Pan-African Purpose, our Pan-African Platform and our Pan-African People.

Lets talk about technology. How has your investment in technology grown and can you say it has impacted your business in the provision of better, faster and easier services to customers?

Many of Ecobank’s successful innovations have been enabled by technology. Our Pan-African payment ecosystem has positioned us as the bank of choice for payments, trade and SMEs, while our ‘One Bank’ model sees us manufacture our products and services centrally and deliver them locally through our affiliates across sub-Saharan Africa.

This means that our borderless unified digital products and services have increased speed-to-market and are available to all our customers – whether they are in a large country such as Nigeria, or a much less populated nation such as São Tomé and Principe.

By leveraging technology, and partnerships such as those we have with mobile network operators such as Airtel and MTN, we provide our customers with convenience, affordability, secure and instant payments and collections, as well as the ability to conduct their banking transactions at anytime and anywhere. Indeed, Ecobank enabled digital transactions totalling $79.7 billion in 2022, an increase of 26 per cent from 2021.

We are driving financial inclusion and have made significant inroads into reducing the numbers of the unbanked – which currently stands at about 40 per cent of the population – by enabling KYC-lite onboarding from a mobile phone and by targeted innovations such as the Fingo app, which is driving financial inclusion among Kenya’s, and shortly sub-Saharan Africa’s, youth through virtual account opening.

How much have you invested in technology so far and how prepared is the bank to leverage emerging opportunities and stay ahead of trends in the industry?

Ecobank’s continuous investments in technology throughout the past decade goes beyond numbers and have been a major reason for the Group’s strong position, market-leading products, solutions and services and our positioning as the bank of choice for payments, trade and SMEs.

Our recent industry recognition as Africa’s Best Bank for SMEs and Nigeria’s Best FX Bank by Global Finance SME Bank awards 2024 confirm our positioning.

The benefit of our wide geographical footprint, which is the largest of any financial services conglomerate in Africa, is delivered and enjoyed by our clients and customers through technology. Resting on our laurels is not an option, and certainly not in our DNA. Our ambitions are aligned with the anticipated and evolving needs of our clients and customers.

A recent example being our Ecobank Single Market Trade Hub which empowers SMEs to grasp the intra-African trade growth opportunities created by the AfCFTA’s single market – or leveraging our banking platform to enable fintechs to open ‘lite’ Banks accounts for their customers by leveraging our Xpress Account API – enabling the next generation of NeoBanks for Africa.We will also leverage the transformational opportunities available by harnessing the power of AI, machine learning, natural language processing, big data and more.

Harnessing technology is a major tool in our armoury to maintain our market-leadership and drive efficiencies in our operations.

What percentage has your Nigerian business contributed to the growth of your bottomline in Q3 and which of the subsidiaries underperformed?

For the nine months to 30 September 2023, Ecobank Nigeria delivered $25 million, or c.6 per cent, of our Group’s $450 million profit before tax. Its net revenue of $190 million accounted for c.13 per cent of the Group’s total $1.518 billion.

Overall Ecobank Group benefits from its diversified operating model. Pursuant to our GTR Strategy, the Group, in its entirety, is on a growth and transformation trajectory, maximizing and leveraging opportunities across the various markets to drive growth.