The Nigerian Transparency Council (NTC), a watchdog organisation, has ignited fresh controversy surrounding the acquisition of OVH Energy Marketing by the Nigerian National Petroleum Company Limited (NNPCL) and its retail group.

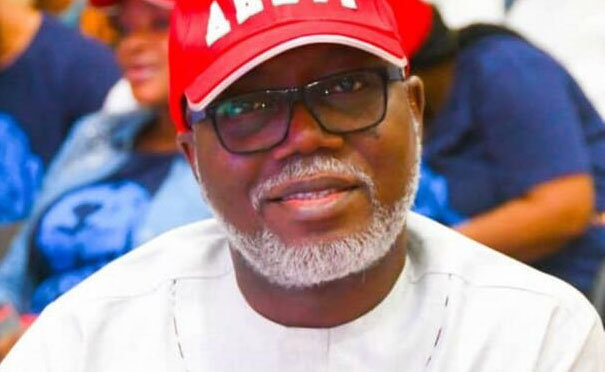

In a petition submitted to the House of Representatives Committee on Downstream Petroleum, led by Hon. Ikenga Imo Ugochinyere, who represents Ideato Federal Constituency, the NTC raises serious concerns about the deal, urging a comprehensive investigation.

Recently, it was disclosed that the NNPCL paid cash amounting to over $325.09 million (N140.559 billion) for the acquisition of Oando-branded retail stations and a reception jetty in Apapa, among other facilities with allegation trailing the acquisition that some of the acquired assets are alleged not to have belonged fully to OVH or licensed.

The NTC, in a statement signed by the group’s secretary general Dr. Ayo Olubunmi, raised doubts about the acquisition’s transparency, and questioned the purchase price and the identity of the seller. They alleged the deal involved hundreds of billions of Naira due to potentially overvalued assets, highlighting a lack of proper investigation. Additionally, the group criticised the absence of publicly disclosed financial details and valuation reports, raising concerns about potential irregularities.

Further fueling the fire, the NTC pointed towards the incomplete merger process between NNPCL Retail and OVH. The formalisation of the merger, according to the statement, remains in limbo, raising questions about the deal’s legitimacy and long-term implications. Additionally, the group flagged a potential conflict of interest, citing the appointment of a Nueoil official to head NNPCL Retail, a company Nueoil previously held shares in.

To ensure an unbiased investigation, the NTC called for the suspension of key figures involved, including Mele Kyari, NNPCL Group CEO, the leadership of NNPCL Retail, and the foreign MD. They urged the committee to conduct a thorough investigation encompassing the acquisition terms, valuation reports, merger process, and all financial transactions associated with the deal.

The NTC expressed dissatisfaction with the previous investigation conducted by the House of Representatives, criticising the lack of in-depth scrutiny into the beneficial owners, financial transactions, and perspectives of NNPCL Retail staff.

They threatened legal action if the Committee on Downstream Petroleum fails to initiate a public investigation within 10 days. Furthermore, the NTC called on the House leadership to investigate the alleged reasons behind the previous committee’s refusal to delve deeper into the deal.