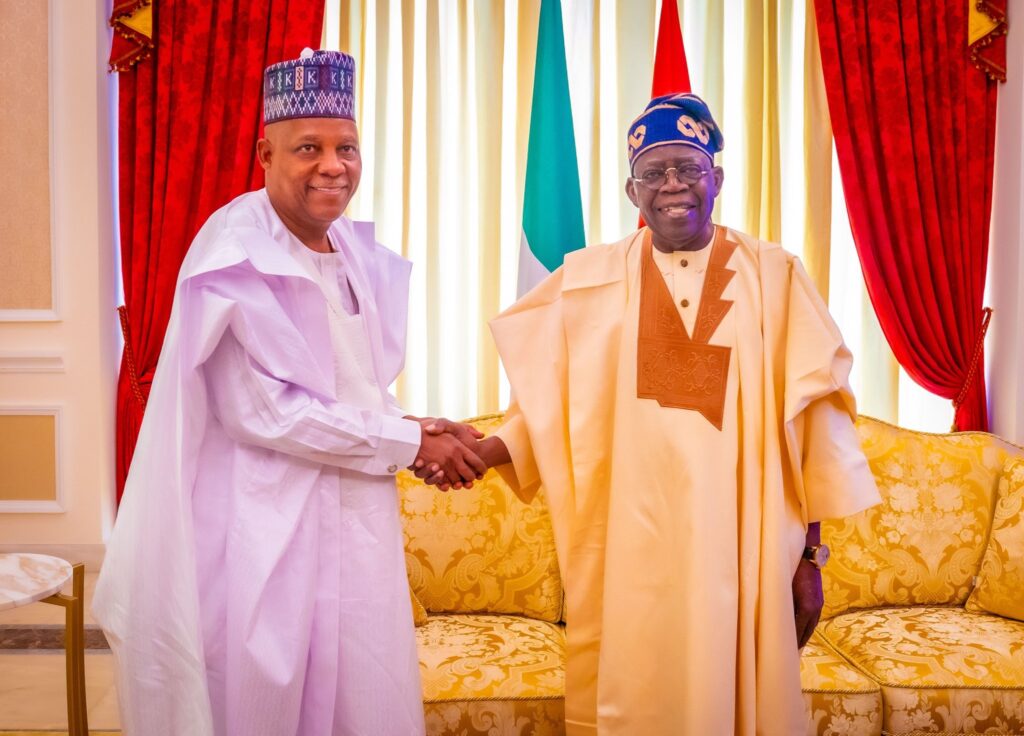

![President Tinubu and Adebayo Ogunlesi during a meeting in Abuja [PHOTO CREDIT: Presidency]](http://35.246.2.216/wp-content/uploads/2024/06/President-Tinubu-and-Adebayo-Ogunlesi.webp)

President Bola Ahmed Tinubu met with the Chairman of Global Infrastructure Partners (GIP), Adebayo Ogunlesi, and his team at the State House, Abuja on Wednesday.

Although details of the meeting are undisclosed. However, sources hinted that their conversation revolved around attracting foreign investments into the Nigerian economy.

Ogunlesi is a Nigerian lawyer and investment banker, who sold his company Global Infrastructure Partners (GIP) to BlackRock in January 2024. He is expected to join the board of BlackRock as part of the deal.

BlackRock had about $10 trillion in assets under its management as of December 2023. The company sits on the kind of liquidity that could help drive the funds needed for the RHIDF.

Ogunlesi has a major stake in the aviation sector, particularly airports. In 2006, GIP bought London City Airport, In 2009, it acquired a majority stake in London Gatwick Airport in a deal worth £1.455 billion.

Nigerian government officials at the meeting were the Minister of Finance and the Coordinating Minister of the Economy, Wale Edun, the Minister of Budget and Planning, Atiku Bagudu, the Chairman of the Federal Inland Revenue Service, Zacch Adedeji, the Minister of Power, Bayo Adelabu, the Chief of Staff the President, Femi Gbajabiamila and others.

Tinubu’s meeting with Ogunlesi was followed by establishment of the Renewed Hope Infrastructure Development Fund (RHIDF).

The Presidency said Tinubu approved the RHIDF to facilitate effective infrastructure development across the pivotal areas of agriculture, transportation, ports, aviation, energy, healthcare and education in Nigeria.

The fund is meant to be invested in critical national projects that will, among other things, promote growth; enhance local value-addition, create employment opportunities, and stimulate technological innovation and exports.

“One of the objectives of the Fund is to establish an innovative infrastructure investment vehicle to attract and consolidate capital, serving as a dynamic driver for economic advancement,” a policy document of the fund read.

“Another objective is to execute strategic and meticulously chosen national infrastructure projects across several key sectors, including road, rail, agriculture (irrigation, storage, logistics & cold chain), ports, and aviation, among others.

“The third is to efficiently utilize and aggregate accessible low-interest loans such as concessionary loans and Eurobonds, supplemented by the procurement of other favourable financing options, in addition to budgetary allocations.”

The fund is expected to help Nigeria secure the most advantageous arrangements for financing, construction, and subsequently, operation and maintenance of the identified projects, ensuring optimal long-term outcomes.