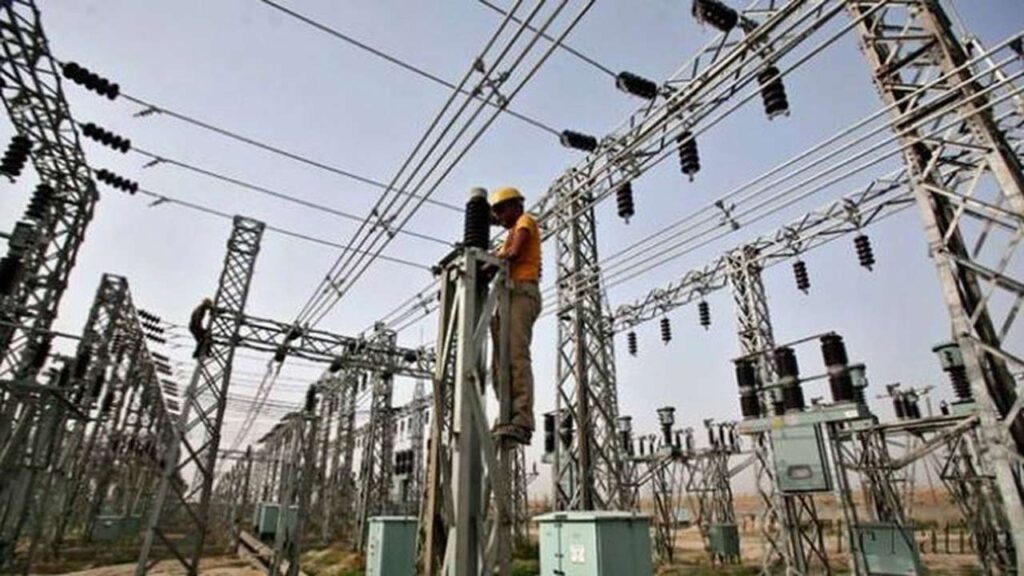

•17 power plants in crisis as generation drops to 2,202MW

The liquidity crisis in the Nigerian power sector has worsened with generation companies (GenCos) receiving 4.68 per of their monthly invoices for March 2024.

This comes as over 60 per cent of the 27 power plants on the grid are on the verge of collapse as only 10 are functioning above 50 per cent.

The Guardian gathered that while invoices for March, which was the latest payment to the GenCos stood at around N270 billion, they only received about N12.6 billion.

This is coming amidst indications that the federal government is expected to, in the next six months, borrow about N1.7 trillion through bond issuance to pay the legacy debt in the power sector.

In the last week, the country’s electricity generation was between 2,000 megawatts and 4,000MW despite the recent increase in electricity tariffs, which is expected to provide Nigerians with more hours of electricity supply.

Yesterday, the electricity distribution companies in the country had an allocation of 3,236MW. But as of 5pm yesterday, the grid only had 2,202MW, meaning that the DisCo had no option to share what was available on the grid.

In the last quarter of 2023, the productivity of grid-connected plants was 38.84 per cent.

Although the figure showed an increase of 5.53 per cent from the 33.31 per cent recorded in the third quarter of 2023.

The Nigerian Electricity Regulatory Commission (NERC) said 60 per cent of the installed capacity in the Nigerian Electricity Supply Industry (NESI) was not available.

“The lack of generation capacity at the upstream segment occasioned by the low plant availability factor poses major risks for any attempts to boost the volume of energy supplied to the consumers through the National Grid.

“Overall, ten plants had availability factors above 50 per cent with the Azura IPP plant recording the highest availability factor of 94.34 per cent,” NERC had said.

While Azura, Dadin Kowa, Ibom, paras, Jebba, Shiroro, Rivers IPP, Kainji, Okpai and Afam VI performed above 50 per cent.

Most of the worst-performing plants are gas-fired plants with plants like Olorunsogo NIPP performing at a dismal seven per cent, Ihovbor NIPP at five per cent, Afam IV-V five per cent and Alaoji at zero per cent.

The Association of Power Generation Companies (APGC) had last week said the capacity of the GenCos to supply electricity to the national grid is being threatened by N3.7 trillion liquidity crisis and secrecy in tariffs.

The APGC said power plants were on the verge of collapse over N2 trillion debt and another N1.7 trillion funding crisis created by the NERC through the supplementary Multi-Year Tariff Order for 2024. Debt owed gas companies currently stand at about $1.3 billion.