As a Nigerian, I know that family is everything to us. But let’s be real, sometimes they strain our finances like crazy and it’s annoying. I’m talking about the constant billings from uncles or aunties who claim they’ve been there since you were a baby. I get it. Family is important, but so is my financial stability abeg.

I’m a UI/UX designer, and I’ve always been the go-to family member & friend for black tax but dishing money out got pretty overwhelming recently, affecting my mental health. Every time I’d get a call for money, I’d feel guilty if I didn’t oblige. I felt drained, both financially and mentally. I remember once, an aunt called me and asked for help with her daughter’s school fees. I had just received my salary and was planning to use it to sort out my rent, but I sent her a huge chunk of the money instead. Another time, my dad asked me to help with his business, and I had to borrow funds from my friend to give him. I was always being pulled in different directions, and I couldn’t say no. I knew I had to find a way out of this non-stop cycle of overspending.

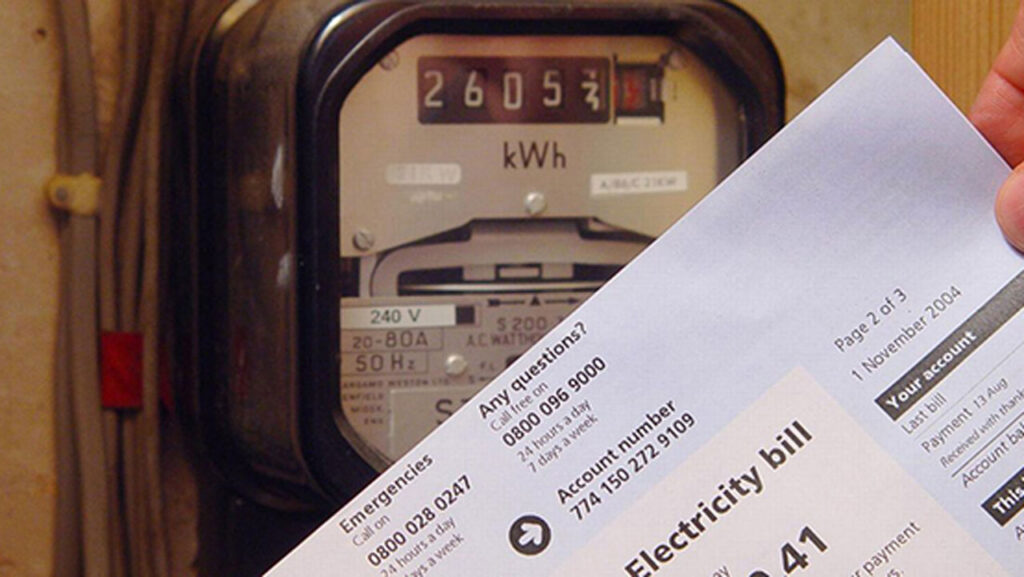

The icing on the cake was when a cousin’s wedding came up, and everyone was looking up to me to buy their aso ebi. That’s when I realized I needed a solution, and fast too. I started thinking about how I could manage my finances better, and that’s when I remembered the 50-30-20 budget rule. Everyone probably learnt this at a young age but we can all agree some things are usually not first instinct especially when adulthood creeps up on you. Well, the 50-30-20 rule is a simple rule that recommends allocating 50% of your income towards necessary expenses like rent and utility bills, 30% towards discretionary spending like entertainment, and 20% towards saving and debt repayment.

I knew I needed something a bit more practical to complement this, something that would help me stick to this rule and avoid indiscriminate spending. Interestingly, I had received an email from gomoney talking about tracking and whatnot so I decided to explore the app a bit more as I had only been making just regular transactions prior to the time. I began to utilise its expense tracking feature to track my expenses and for the first time in a while, I had an aerial view of my finances. I was fascinated by the detail of my monthly money moves available on the gomoney app. The insights over time definitely helped me cut back on black tax.

I also started using the split bill feature on the app. Whether they liked it or not, I started sharing expenses with my family and friends after getting them signed up on gomoney, and we could all contribute what we could afford to the table. No more feeling like everybody’s personal money tree. This way, we’re all able to prioritize our own financial goals, and it’s been a huge relief. Man can finally breathe!

I’ve also become very disciplined with my goStash for saving, and I can see my money growing. Most importantly, saying a big NO to random and inconvenient requests has become my favourite money management habit. It’s not been easy, but like they say, nothing good comes easy. This change is necessary for my personal finances and I know it’s going to be worth it in the long run.

So, if you’re a Lagos big boy or top girl, you don’t have to go bankrupt due to an unending black tax. With gomoney and some financial discipline, you too can take control of your finances and still show love to your family. Remember it’s okay to put yourself first sometimes. You deserve it and more. Take charge of your money moves today.