The Indian Rupee (INR) has recently experienced a depreciation against the US Dollar (USD). This decline weakens India’s purchasing power in the international market and increases the cost of imports, particularly for essential commodities like oil. Recognizing this vulnerability, India has embarked on a strategic journey to internationalize the INR, aiming to establish it as a potential alternative reserve currency.

The Sting of Depreciation

India’s dependence on oil imports makes it acutely sensitive to currency fluctuations. A weaker INR translates to higher import bills, placing a strain on the national budget and potentially fueling inflation. This recent depreciation coincides with a global rise in oil prices, creating a double whammy effect for the Indian economy.

Taking Charge: The Rise of Rupee-Based Trade

In a proactive response, India has initiated measures to promote the use of INR in international transactions. A key strategy involves signing agreements with countries like UAE, allowing oil purchases to be settled in INR. These “roundabout arrangements,” as the text describes, lessen reliance on USD and strengthen the INR’s position in specific trade partnerships.

The Reserve Bank of India (RBI) is further expanding this initiative by facilitating INR trade settlements with 18 countries. This involves establishing Special Vostro Rupee Accounts (SVRAs) for participating banks, enabling them to conduct transactions directly in INR.

The Long Game: Benefits of Internationalization

The ultimate objective of these efforts is to achieve internationalization of the INR. This ambitious goal carries with it a multitude of potential benefits:

- Reduced Exchange Rate Volatility: A more widely used INR would be less susceptible to sharp fluctuations against other currencies, providing greater stability for businesses and investors engaged in international trade.

- Enhanced Capital Inflows: As the INR becomes a more attractive and stable currency, foreign investments are likely to rise. This would inject fresh capital into the Indian economy, fostering growth and development.

- Improved Current Account Deficit: Reduced import costs due to a stronger INR would help narrow the gap between India’s imports and exports. This, in turn, strengthens the country’s overall balance sheet and financial health.

- Geopolitical Influence: Increased economic ties fostered through INR trade could translate to greater geopolitical influence for India. Bilateral trade agreements denominated in INR would solidify partnerships with other nations, potentially enhancing India’s position on the world stage.

- Reduced Pressure on RBI Reserves: A stronger INR would lessen the need for the RBI to maintain a massive USD reserve, freeing up resources for other economic priorities such as infrastructure development or social welfare programs.

The American Example: A Currency Powerhouse

The US Dollar (USD) is the world’s dominant reserve currency. The USD’s preeminence allows the US to print more money with relative ease and borrow from other countries. This economic leverage is a significant advantage on the global stage.

India’s Rise: A Star Ascendancy with Currency Ambitions

India’s rapid economic growth trajectory positions it as a strong contender for a future with a more prominent INR. Its inclusion in major indices like the Global Emerging Market Bond Index by JP Morgan and Bloomberg reflects growing global confidence in the Indian economy. The government and RBI’s push for INR internationalization is a well-timed and strategic move, capitalizing on India’s economic momentum.

Beyond Cost Savings: A Win-Win for All

Internationalizing the INR would not just save India transaction costs on foreign trade, but also invigorate its financial market. Increased capital flow into debt and equity markets would enhance liquidity and investor confidence. A stable INR would benefit both Indian consumers by boosting purchasing power and global investors by offering better returns and reduced currency risk. Ultimately, this initiative has the potential to create a win-win situation for India, attracting foreign investment and promoting domestic economic growth, while also fostering a more stable and diversified global financial system.

Market Volatility: A Temporary Hiccup?

There is a recent market volatility in India, potentially triggered by geopolitical tensions. While the short-term outlook suggests a cautious “sell on rise” approach for investors, the long-term prospects for the Indian market remain positive, especially with the potential for a strengthened INR.

In essence, India’s push for INR internationalization is a transformative strategy with far-reaching implications. It aspires to not only bolster India’s economic standing but also contribute to a more balanced and resilient global financial landscape.

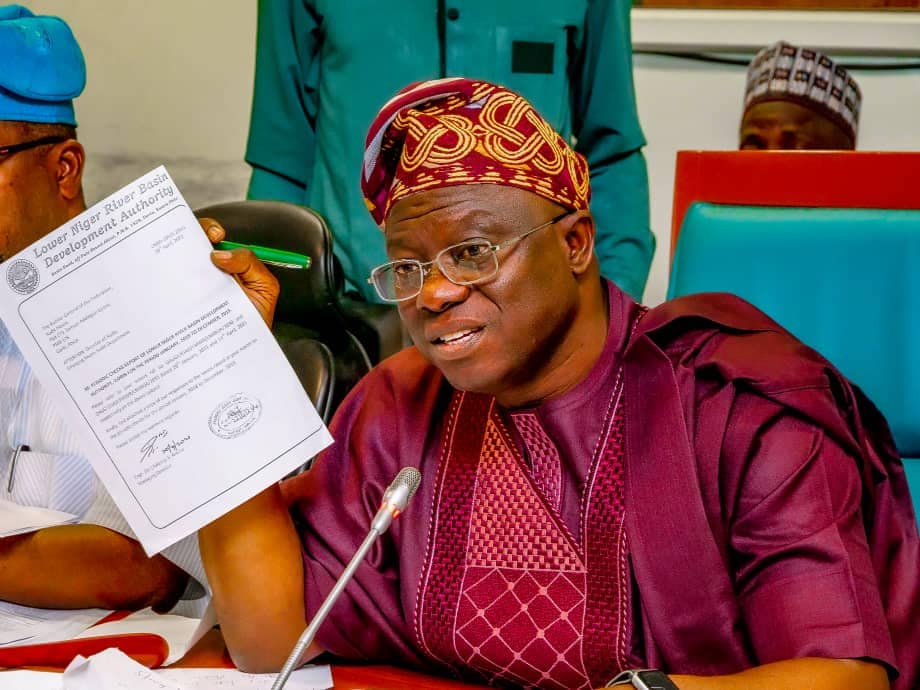

By Sahid Musa, a market analyst writes from Abuja