The International Monetary Fund (IMF) has called for an increase in current amount of deposit insurance coverage provided by Nigeria Deposit Insurance Corporation (NDIC) to reflect inflation and currency depreciation in the country.

The IMF revealed this in its latest evaluation of Nigeria’s financial landscape, saying that such a move will aid in mirroring better the current economic realities of inflation and currency reduction.

The group also commended the Central Banks of Nigeria (CBN) on its policies and actions taken to mitigate banking system risks.

The IMF underscored the importance of bolstering deposit insurance and improving stress testing procedures.

The organisation said the stress tests conducted by the CBN revealed potential vulnerabilities, with banks’ Capital Adequacy Ratio (CAR) possibly plummeting to six per cent under severe stress scenarios.

According to them, the situation has led to the commendation of the CBN’s directive for banks to retain foreign exchange gains and fortify their capital bases.

Also, the IMF lauded the CBN’s decisive steps in revoking the licenses of non-compliant microfinance banks and ensuring the protection of insured depositors.

It further recommended policy actions to strengthen the banking sector’s resilience.

“These include a gradual increase in deposit insurance coverage, the monthly conduct of stress test scenarios with preemptive actions for banks failing to meet regulatory standards, the necessity for banks’ shareholders to infuse new capital in response to falling capital levels, and the transparent disclosure of financial soundness indicators for individual banks alongside details of regulatory compliance measures.”

However, the Nigeria Deposit Insurance Corporation (NDIC) is on the brink of enhancing the safety net for bank depositors with a planned review of its maximum deposit insurance coverage.

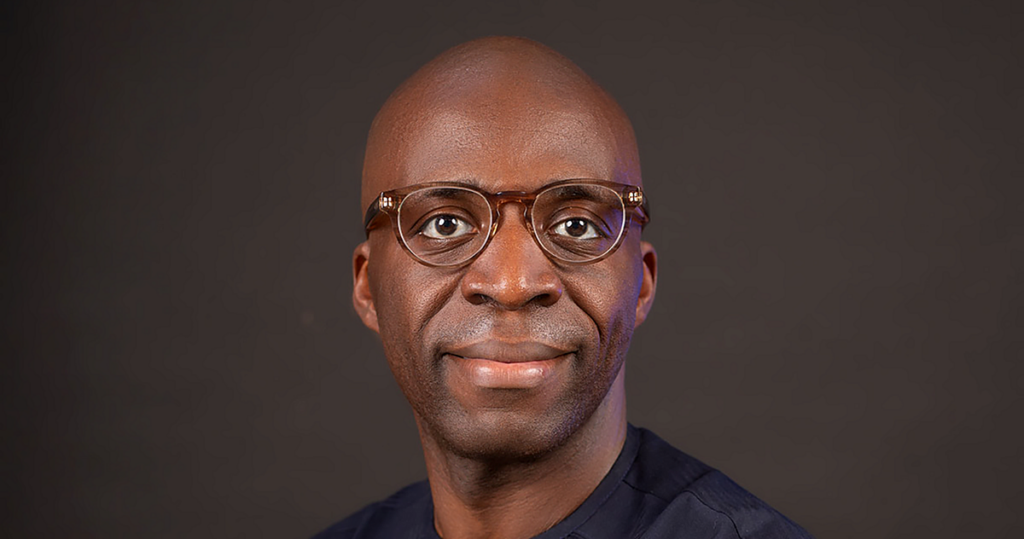

The NDIC’s Managing Director/Chief Executive Officer, Bello Hassan said the strategic move is expected to adjust the insurance coverage to reflect the evolving macroeconomic landscape, marking a significant step towards bolstering depositor confidence in the financial system.

Hassan stressed that NDIC is in the final stages of reassessing its deposit insurance limit, a change prompted by the need to address the impacts of recent macroeconomic developments.

While specific details of the proposed new coverage level were not disclosed, Hassan emphasised the critical role this enhancement will play in strengthening the trust of depositors in the NDIC’s guarantee scheme.

Currently, the NDIC insures deposits up to N500,000 for depositors in Deposit Money Banks (DMBs) and Primary Mortgage Banks (PMBs) and up to N200,000 for depositors in Microfinance Banks (MFBs), providing a safety net in the event a financial institution fails.