. Uncertainty about naira recovery over rate disparity

. NCS system slows Form M adjustment, others

. CPPE seeks CBN, fiscal authority’s collaboration on import duty

Unless urgent measures are deployed, the gap in food sufficiency, prices of goods and citizens’ unhealthy lifestyles could be further compounded and dampened as a result of the high customs duty exchange rate. The hike and instability of the rate have continued to impact, especially the prices of goods in the market, making it difficult for Nigerians to experience a decent living.

The import duty exchange rate remains higher than the Central Bank of Nigeria (CBN) official market rate for FX, which was reduced by 5.97 per cent on March 27 to N1,300.43/$1 from N1,382.95/$1 on March 26 and N1,408.04/$1 on March 25, 2024.

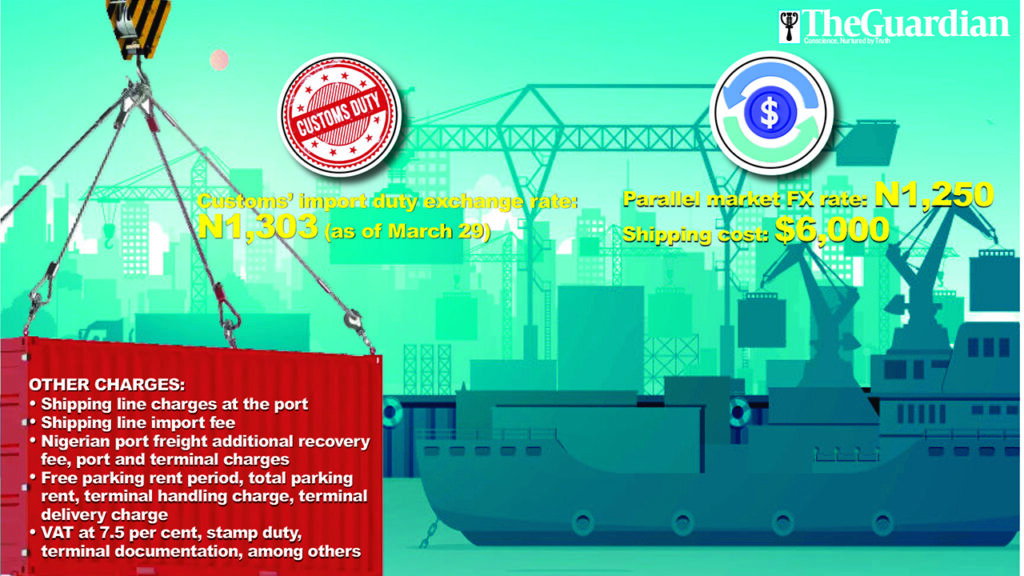

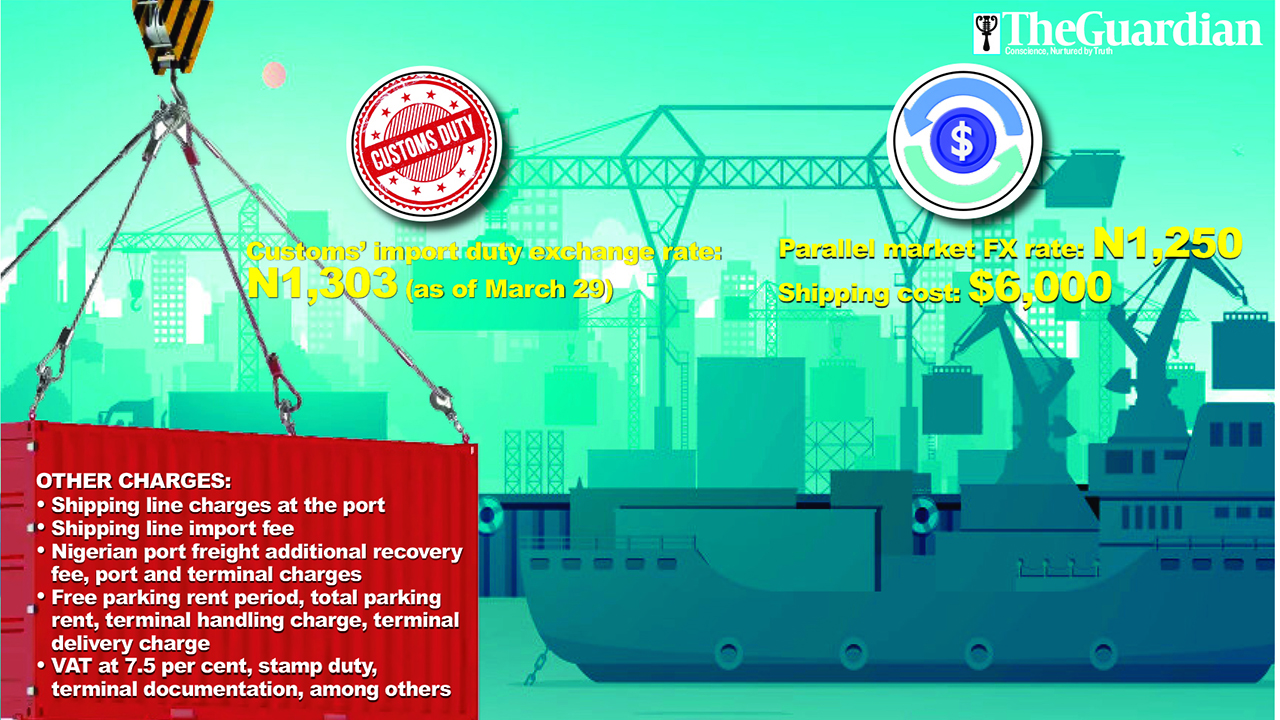

The CBN again reduced the Customs duty exchange rate on the customs portal to N1,303 /$1 as of March 29 and then to N1364.879/$1 on March 27 from the N1,405.466/$1 on March 26.

Also, the rate has seen a steady reduction this month as it was first slashed to N1,612/$1 on March 15. The rate was further reduced to N1,593/$ 1 on March 16 and later slashed to N1,572/$1 on March 19 and N1,448/$1 on March 23.

The exchange rate for import duties payment on the customs portal, which has been steadily declining over the past two weeks, reflects the naira’s strengthening in the FX market.

However, the customs duty exchange rate is still higher than the Parallel Market (Black Market), which appreciated by 6.25 per cent and sold for N1,350/$1 as of March 27 from N1,440 as of March 25, 2024.

The Bureau de Change (BDCs) operators in Lagos quoted the buying rate of the greenback at about N1250/$.In the black market, the buying rate for a dollar was N1,240 and sold at N1,280 as of March 31, while at the Nigerian Autonomous Foreign Exchange Market, the dollar closed at N1309/4 on March 28.

The duty exchange rate is also higher than the N1,269.8/$ rate the CBN directed BDC operators to sell at in its new operating rules.Indeed, the seeming instability is causing disquiet in the system as the confidence that the market is starting to enjoy is now on shaking legs.

As monitored, the naira is stronger in the black market than in the official market. Observers said while the driving force behind the resurgent naira is difficult to pin on specific factors, there is fear that the same forces may equally conspire against the currency, which may result in a free fall.

What is certain is that those who have stored foreign currencies are also in a state of confusion as uncertainties persist.Further, The Guardian learnt that Customs’ technology and systems are making it extremely difficult to adjust the rate of Form M.

It was also gathered by The Guardian that, aside from the customs’ duty exchange rate inflating the duty for clearing, other terminal and port charges also affect the total cost of clearing goods, thereby increasing the prices of goods in the market.

The charges include a $6,000 shipping cost from the United States to Nigeria, shipping line charges at the port, shipping line import fee, Nigerian port freight additional recovery fee, port and terminal charges, free parking rent period, total parking rent, terminal handling charge, terminal delivery charge, VAT at 7.5 per cent, stamp duty, terminal documentation, among other charges paid before releasing the goods from the ports.

The prices of car parts have increased due to the challenges, the price of a Ford Focus salon battery, which was sold for N38,000 now costs N49, 000, the price of Honda EOD fairly used front bumper, which was sold for N40,000 now sells for N140,000, while Toyota Corolla’s fairly used front bumper rose from N45,000 to N250, 000.

On the issue, the Chief Executive Officer of the Centre for the Promotion of Private Enterprise (CPPE), Dr Muda Yusuf, stated that the import duty rate, according to regulation, should be determined using the prevailing exchange rate, as the President and the Central Bank of Nigeria (CBN) aimed to reduce inflation.

He highlighted that the high cost of trade affects not only imported goods but also production, as raw materials are imported at exorbitant rates. Yusuf also mentioned that compatibility issues with Customs’ technology and systems complicate rate changes from one Form M to another and adjust the technology accordingly.

He appealed to the CBN to collaborate with fiscal authorities to fix the import duty exchange rate at N1,000/$1 for the remainder of the year. Yusuf emphasised the need to consider broader economic indicators, focusing on products, trade, and policies to mitigate current challenges without undermining ongoing government reforms.

A member of the Former Presidential Task Force to Reform the Nigeria Customs Service (NCS), Lucky Amiwero, referenced Section 16 of the Central Bank of Nigeria Act of 2007, which stipulates that the Naira’s exchange rate shall be determined by a suitable mechanism devised by the Bank.

He advocated strict compliance by the Nigeria Customs Service with a recent CBN circular mandating the use of the closing forex rate on the date of opening Form M for import duty assessment, to alleviate economic tension.

The National Public Relations Officer of the Association of Registered Freight Forwarders of Nigeria (AREFFN), Taiwo Fatomilola, noted that apart from the import duty exchange rate, shipping costs and other charges contribute to high prices of goods in the country.

He compared shipping costs in Nigeria with those of neighbouring countries, suggesting that higher costs lead to goods being diverted through those countries.

The Vice Chairman of the Business Action Against Corruption (BAAC) Integrity Alliance, Lagos, Jonathan Nicol, called for a reversal of the customs duty exchange rate to foster development, suggesting a special window at the CBN to attract investment and stabilise the rate.

When contacted, the National Public Relations Officer of the Nigeria Customs Services, Abdullahi Maiwada, deferred comments on monetary policy and exchange rate determination to the CBN, stating that Customs focus on enforcement rather than monetary policy.

“Kindly meet the CBN, we are not responsible for monetary policy and fixing the exchange rate, I may not have anything to say about monetary policy,” he stated.