In today’s fast-paced and complex world, wealthy individuals and families face unique challenges in effectively managing their wealth and passing it down to future generations. These challenges are captured in the popular sayings like “shirtsleeves to shirtsleeves in three generations” and the Chinese equivalent “from peasant shoes to peasant shoes in three generations.”

In today’s fast-paced and complex world, wealthy individuals and families face unique challenges in effectively managing their wealth and passing it down to future generations. These challenges are captured in the popular sayings like “shirtsleeves to shirtsleeves in three generations” and the Chinese equivalent “from peasant shoes to peasant shoes in three generations.”

A strategic attempt to combat the likely loss of wealth over time has led to the establishment of Family Offices, dedicated to preserving wealth and addressing the long-standing issue of wealth sustainability across generations.

A family office is a private wealth management arrangement/structure that serves ultra-high-net-worth individuals and families. Its main objective is to provide a comprehensive approach to managing and preserving family wealth for current and future generations.

Family offices have been in existence for many years, providing a range of services such as investment management, estate planning, philanthropy, and governance to wealthy families. However, they are just beginning to gain prominence in Nigeria as more families recognize the importance of professional guidance in managing and preserving their wealth for future generations.

There are several reasons why families looking to achieve cross-generational prosperity should consider the use of Family Offices.

One fundamental benefit lies in its ability to customise services and strategies according to the unique requirements and aspirations of each family it serves. By determining key goals and assessing risk tolerance, a family office can construct a personalised strategy for wealth preservation that aligns with the values, vision, and aspirations of the family.

Also, family offices employ a holistic and integrated approach to wealth management. It considers not only the financial assets but also the family dynamics, governance structures, and legacy planning. By harmonising these elements, a robust framework that addresses immediate financial concerns while also ensuring long-term wealth preservation across generations is created.

Moreso, in a fast-changing global landscape, risks and uncertainties are ever present. Family offices are equipped with diverse skills and expertise in the areas of financial advisory, tax planning, legal advisory, and investment management to mention a few. These specializations will support the family in navigating the intricacies of managing and growing its resources. By actively managing risks, diversifying portfolios, and identifying emerging trends, the family’s wealth can be shielded from external threats while capitalising opportunities.

Preserving generational wealth and ensuring its smooth transition between successors necessitates meticulous planning. Family offices play a pivotal role in guiding families through the complex process of intergenerational wealth transfer. By assisting in crafting effective estate plans, facilitating family governance, and establishing structured mechanisms, it paves the way for a lasting legacy.

Beyond managing financial assets, family offices place immense importance on sustaining family harmony and emotional well-being. By cultivating a culture of open communication, trust, and education, it helps family members navigate the intricate dynamics of wealth, fostering unity and purpose among generations.

The family office employs various tactics to preserve wealth and ensure transfer to future generations. A few of these strategies involve:

Investment management: Family offices employ investment professionals who develop and manage investment portfolios tailored to the family’s risk tolerance, return objectives, and investment preferences. This ensures the family’s wealth is invested wisely to generate sustainable returns while mitigating risk.

Estate planning and succession: A family office works closely with the family to devise an effective estate plan that aligns with the family’s wishes for asset distribution and the transfer of control over various entities. This includes the preparation of wills, trusts, and other legal documents to ensure a smooth transition of wealth between generations.

Risk management and insurance: It assists in identifying and managing risks that could impact family wealth. This includes evaluating insurance needs, such as life insurance and liability coverage, to protect the family’s assets and interests.

Philanthropy and social impact: Many wealthy families have a desire to give back to society and make a positive impact. A family office can help families formalise their philanthropic efforts by establishing foundations, managing charitable giving, and measuring the impact of their donations.

Governance and family education: It helps establish governance structures and family constitutions that outline decision-making processes and responsibilities. Additionally, it provides educational programs to equip family members with financial literacy skills necessary to manage their wealth effectively.

Succession planning: Through careful succession planning, a family office helps identify capable family members to assume leadership roles within various business entities or philanthropic organisations. This ensures a smooth transition of management control and preserves the family legacy.

Family meetings and communication: The team of professionals facilitates regular family meetings where all members can gather to discuss financial matters, strategic decisions, and any wishes or concerns related to wealth transfer. This creates an open and inclusive environment that fosters understanding and unity among family members.

Trusted advisors and professional network: A family office builds a network of trusted advisors, including lawyers, accountants, and financial planners, who can provide independent counsel to family members. This ensures objective decision-making and minimises potential conflicts of interest.

Multigenerational investment strategies: The team works with families to develop investment strategies that cater to the unique needs and risk profiles of both older and younger family members. This helps ensure the sustainable growth of wealth across generations.

It is worth mentioning that there are iconic families around the world that have successfully used the family office as tool to preserve and transfer wealth for generations. Examples of these families include;

The Rockefeller Family: The Rockefeller family, famous for their wealth in the oil industry, has successfully used a family office to preserve and transfer their wealth for several generations. Their family office, Rockefeller & Co., manages investments, philanthropy, and other financial matters on behalf of the family.

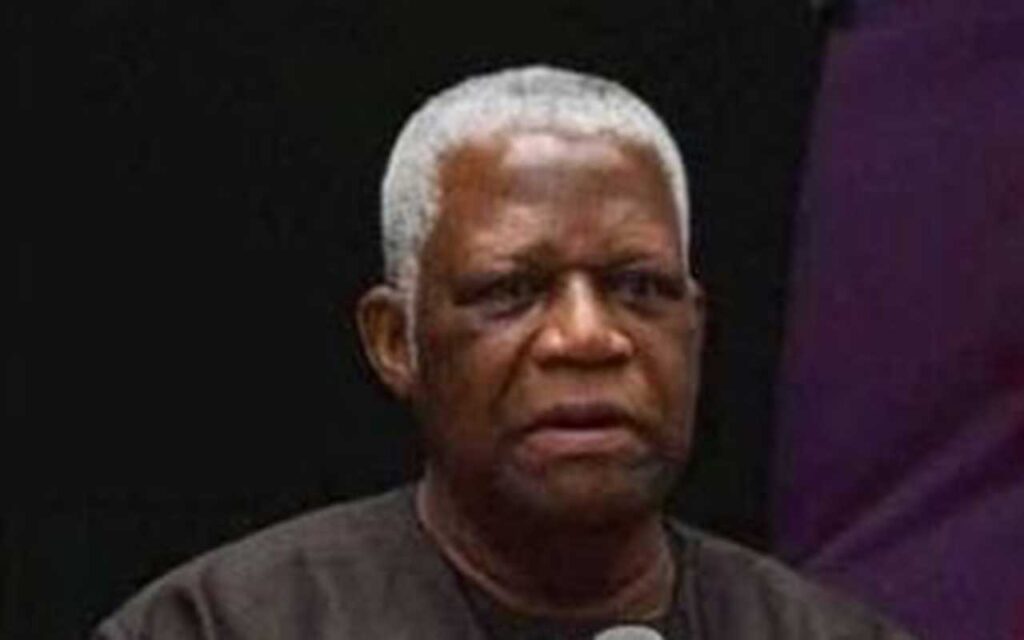

TY Danjuma Family Office: The TY Danjuma Family Office is a privately-owned firm that handles the wealth of Nigerian billionaire Theophilus Yakubu Danjuma. Located in Surrey, England, the firm invests in various assets including public market equity, fixed income portfolios, alternative investments, real estate, and private equity. Additionally, they invest in a range of industries such as art, movie production, industrial gases, and pharmaceuticals.

The Walton Family: The Walton family, founders of Walmart, established the Walton Enterprises family office to manage their vast wealth. This family office focuses on investment management, philanthropy, succession planning, and various administrative functions for the family.

Family offices are not limited to these iconic examples as numerous successful families around the world have implemented same to preserve and transfer wealth for generations.

In conclusion, managing and preserving wealth in a constantly evolving financial environment can be complex. A family office is a valuable tool that helps affluent families effectively manage, preserve, and transfer their wealth to future generations.

By utilising a family office, families would not only safeguard their wealth but also create a lasting legacy that goes beyond monetary wealth, but one that encompasses values, traditions, and unity among family members.

Aisha is a wealth advisor at the Meristem Family Office.