1.2m students to benefit in first batch

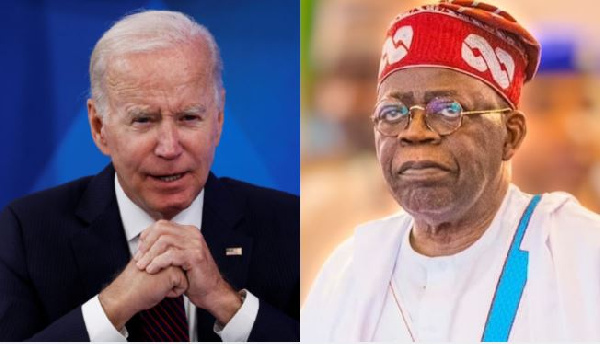

After weeks of suspense, the eagerly awaited students’ loan of the Bola Tinubu-led administration that seeks to offer educational loans to students and skilled workers will open its portal next Friday, May 24.

A statement on Thursday night by the Media and Public Relations Lead of Nigerian Education Loan Fund (NELFUND), Nasir Ayitogo, urged students to access the portal on www.nelf.gov.ng to begin application. According to the statement, the portal provides a user-friendly interface for students to submit their loan applications conveniently.

“The management of NELFUND, led by Mr Akintunde Sawyerr, is thrilled to announce May 24 as official date for opening of portal for student loan applications.

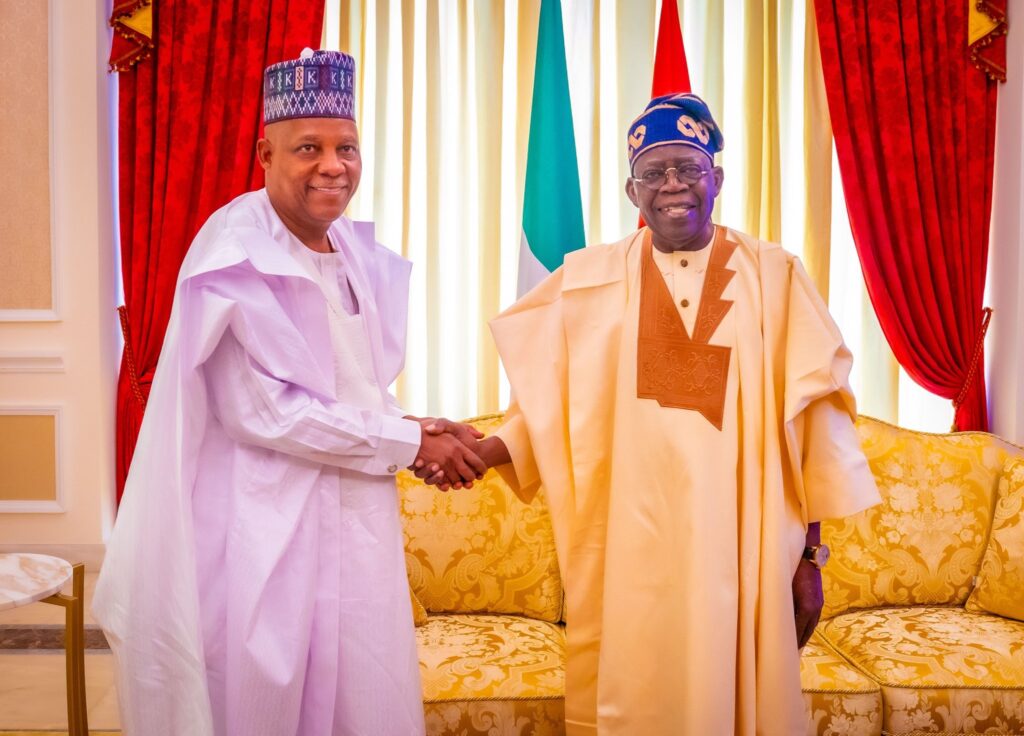

“This marks a significant milestone in the commitment of President Bola Tinubu to fostering accessible and inclusive education for all Nigerian students.

“Through the portal, students can now access loans to pursue their academic aspirations without financial constraints.

“We encourage all eligible students to take advantage of this opportunity to invest in their future and contribute to the growth and development of our nation,” the statement read.

Sawyerr had earlier said 1.2 million Nigerian students in tertiary institutions and government-recognised skill acquisition centres are expected to be among the first batch of beneficiaries.

Recall that President Tinubu had last month signed the Student Loans Act 2024, into law, with a promise that no student would be denied the opportunity to build his future regardless of background.

The Act empowers the Nigeria Education Loan Fund (NELFUND) to provide loans to qualified Nigerian students for tuition, fees, charges and upkeep during their studies in approved public tertiary institutions and vocational and skills acquisition establishments in the country. The new law which repeals the Student Loan Act, 2023, removes the family income threshold so Nigerian students can apply for these loans and accept responsibility for repayment according to the Fund’s guidelines.