The Federal Government, through the Ministry of Finance, on Tuesday, directed all Ministries, Departments, and Agencies (MDAs) to remit 100 per cent of their internally generated revenue (IGR) to the Sub-Recurrent Account, which is a sub-component of Consolidated Revenue Fund (CRF).

This is to improve revenue generation, fiscal discipline, accountability and transparency in the management of government financial resources and prevent waste and inefficiencies.

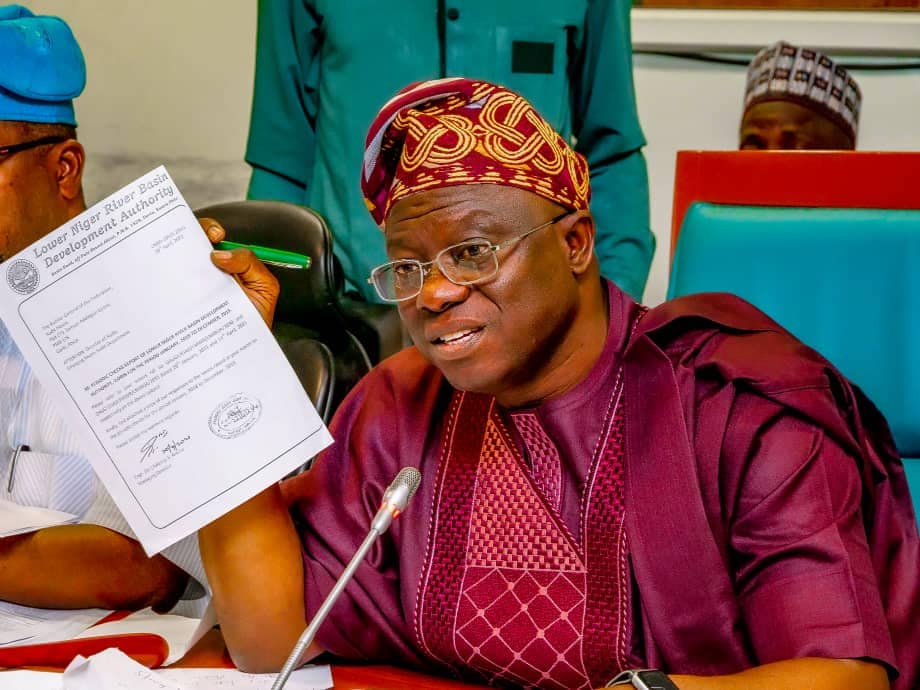

Wale Edun, Minister of Finance and Coordinating Minister of the Economy, issued the directive in a circular dated December 28, 2023.

Consequently, the circular stated that the Office of the Accountant-General of the Federation shall open new Treasury Single Account (TSA) sub-accounts for all federal agencies/parastatals listed on schedule of Fiscal Responsibility Act, 2007 and any additions by the Federal Ministry of Finance, except where expressly exempted.

“All MDAS that are fully funded through the annual FG budget (receiving personnel, overhead and capital allocation) and on schedule of Fiscal Responsibility Act, 2007 and any addition by Federal Ministry of Finance should remit one hundred percent of their IGR to the Sub-Recurrent Account which is a Sub-component of the CRF”, the circular reads.

The circular stated that all partially funded FG agencies/parastatals (receiving capital or overhead allocation from the budget) will remit 50 per cent of their gross IGR, while all statutory revenue like tender fees, contractor’s registration, sales of government assets should be remitted 100 per cent to the sub-recurrent account.