It is no longer news that there is hardship in the country, but what people want to hear is the solution. It is in pursuit of these solutions that stakeholders at the Economists’ Conference assembled top-notch economists to dissect the challenges and proffer solutions, JOSEPH CHIBUEZE reports.

Nigeria’s economic situation has thrown up a big question – is the country at a crossroads or has a direction being taken? This stems from the lack of a clear-cut policy direction, leaving the economy in a free fall. The managers, on their part, appear like blind men groping in the dark as they search for the control board.

Nigeria is witnessing the worst economic situation in its history, worse even than it was during COVID-19. There is hardship everywhere – the cost of living is soaring, food inflation is at its highest at 35 per cent and citizens are dying of hunger. The exchange rate has continued to fluctuate with the local currency at its lowest, exchanging for over N1,700 to a dollar while the output is at the lowest in about a decade in dollar terms even though it grew slowly at 3.46 per cent in the fourth quarter of 2023. Little wonder there have been pockets of protest in different parts of the country, while the organised labour is asking for a N1million minimum wage.

So many things have been blamed for the nose-diving indicators, including the high cost of governance which has left the country in nearly N100 trillion in public debts. This is happening at a time when revenue generation is falling, with the country said to be spending a huge chunk of its yearly revenue, up to 90 per cent, on debt servicing leaving very little for physical development.

Of course, the insecurity that is ravaging the land is exacerbating the situation, scaring away investors and keeping farmers out of their farms, leading to food shortages.

At the virtual conference attended by The Guardian, the Chief Executive of Financial Derivatives Limited, Bismarck Rewane, said Nigeria’s economic problems are well documented and known to be deteriorating over the last 30 to 40 years whereas little efforts have been made to reverse the trend.

He said one of such is the monetary issue where the money supply is growing faster than the gross domestic product (GDP), thus fueling inflation. He also spoke about the interest rate that has fallen below the rate of inflation, leading to a negative real return.

On the fiscal side, he said, there is an inefficient tax system as well as the leakages and the challenge of stranded assets.

“If you put that together, you have a negative government multiplier and negative investment multiplier. There were no clear-cut destinations when the government came up with reform measures,” said Rewane.

Rewane insisted that he was not sure that the government knew the path to the destination.

He said there is no need for new policies as those on the ground are good enough to see the country out of the woods if they are properly managed.

“What we need is institutional reforms to ensure that the policies are impactful,” he added.

He said that Nigeria is not only at a crossroads, “but we are at such a point where you are damned if you do nothing. If you do nothing, you crash out, if you do something, there is the likelihood that you will succeed. So, there is no guarantee that any set of cocktails of options will pull us out. However, if you do nothing, one thing is sure, you are bound to crash.”

He said Nigeria needs to stop doing what he called “some dumb things”.

“You cannot have price control and commodity boards when you are asking people to bring in their money and trade or reinvest. If we are going for an investment-led strategy, then we need to have an investment culture and an investment-friendly environment,” he said.

For the Chief Executive of Think Business Africa, Dr Ogho Okiti, Nigeria’s long-term problem is that it has not been able to organise its fiscal policy and streamline expenditure.

“The last eight years have been a record-breaking debt expansion and deficit budgeting,” he said. He said other falling economies Nigeria points to in vain efforts to generalise the Nigerian problems do not have the same fundamentals.

“They enter recession now, by the end of the year, they are out of it and are bouncing,” he said.

He said while most countries have regained the size of the economy they had before COVID-19; Nigeria has not regained the size of its 2015 economy.

“So, we had a whole eight years without making progress; we were just busy wasting money,” he said.

He added that the people have lost confidence in the economy, the naira and, by extension, the government.

For Okiti, the government’s attention should pursue stabilisation and not growth. He said there would be no growth if the nation does not stabilise the economy, noting that monetary tools are not sufficient in addressing the challenges, insisting that concrete fiscal policy measures are needed to address the situation the country currently finds itself in.

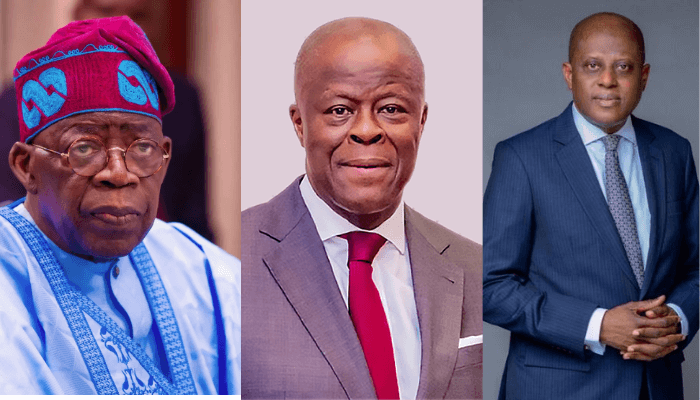

On assumption of office on May 29, 2023, President Bola Tinubu embarked on some radical economic reform measures such as the removal of subsidies on petroleum products as well as the unification of the exchange rates. These, he thought, were needed to turn around the economy on a positive trajectory.

Unfortunately, the country has not experienced any respite; rather the situation has worsened.

A former Statistician General of the Federation, Dr Yemi Kale, in his submission, said Nigeria is not at a crossroads.

“We have a direction; the only thing is that we are in the wrong direction. What we need now is to turn around and go back. We need to have a policy framework that understands that all sectors need to work together and not in isolation. There has been very little impact analysis done before policies are announced. We cannot be picking and choosing which problem we want to solve, everything is now interconnected,” he said.

He said what the government needs to be doing now is rather than giving farmers fertiliser to continue their subsistence farming, it should be thinking of turning them into large-scale farmers and setting up agro-processing facilities for them.

He also suggests that Nigeria reduces its focus on oil and gas and moves to other areas with huge potential like the creative and the financial technology industries.

Also speaking, the Special Adviser to the President on Economic Matters, Dr Tope Fasua, said the country was at an inflection point where growth is becoming more certain.

“I am optimistic that things will pick up. I see hope, things are being turned right. There may have been mistakes here and there, but there are a lot of improvements,” he said.

He said there’s a need for a lot of behavioral change among Nigerians to align with the reality on the ground. He wondered why parents would still insist on sending their children to study abroad given the exchange rate issues.

He said contrary to the call for the reversal of the two policies the government has made, especially the removal of fuel subsidy which he said appears to be coming back because of the drop in the value of the naira, this is the time to assess and reassess the policies.

Dr Ayo Teriba, CEO of Economic Associates, said Nigeria should begin to de-emphasise industrial production and focus on building the skills of its citizens for export like India.

He also noted that Nigeria should begin to maximise her asset value which has been lying dormant. Giving an example of real estate which he said are laying waste at a time when the private sector is making a kill in that area, Dr. Teriba said, Nigeria is not at a crossroads, it has only faced a dead end of trying to rely on production rather than exploiting the huge opportunities in its assets.

“We need to explore the possibilities in our assets like the United States, India and Saudi Arabia that are growing steadily. Our exchange rate inadequacy cannot be solved by production and exports, but we can turn to our assets and decide on which assets to offer investors to attract foreign exchange and shore up our reserves. We can sell shares in the companies we own within a month or three months, we can leverage our real estate assets, we can even export our infrastructure opportunities,” he said.