A fellow of Chartered Institute of Taxation of Nigeria, (CITN), Mr Francis Uzoma Ubani, has said some provisions of Finance Acts 2021 and 2022 are unconstitutional.

A fellow of Chartered Institute of Taxation of Nigeria, (CITN), Mr Francis Uzoma Ubani, has said some provisions of Finance Acts 2021 and 2022 are unconstitutional.

He also said the collection, recovery and distribution of revenue from stamp duties/electronic money transfer (EMTL) by the Federal Inland Revenue Service (FIRS) is unlawful and contrary to the provisions of Sections 2(2) and 163 of the 1999 Constitution of the Federal Republic of Nigeria as amended.

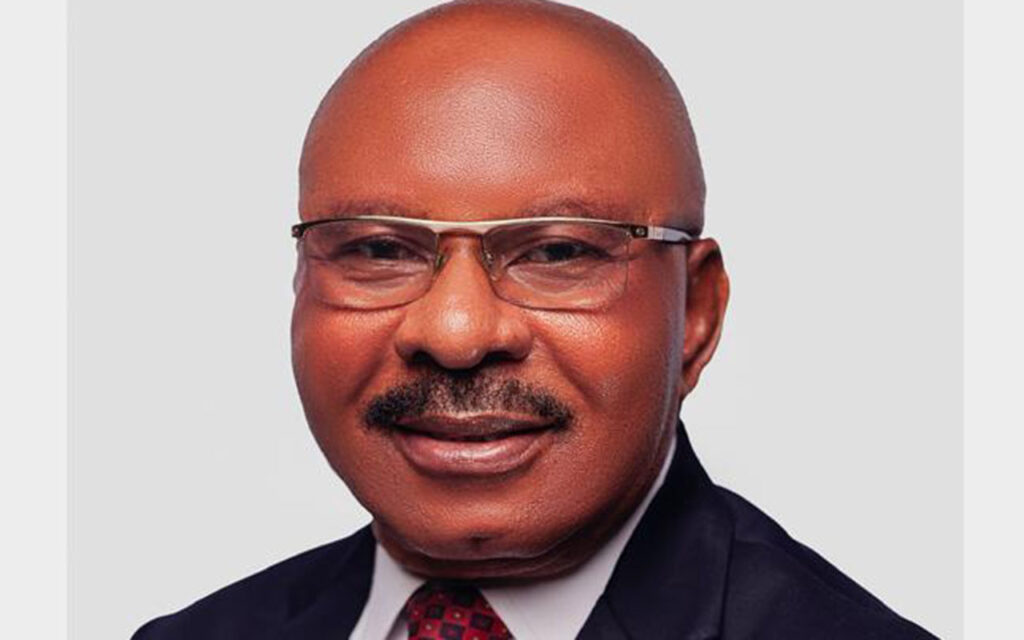

He stated these in his letter to the Executive Chairman of FIRS, Dr Zacch Adedeji, which was made available to journalists on Tuesday.

He pleaded with the FIRS boss to direct the deposit money banks and other financial institutions to immediately begin to remit qualified chargeable stamp duties/EMTL accruable to the different federating states of the Federation, pursuant to Section 4 (2) of the Stamp Duties Act, as amended, to “relevant tax authorities in the various states of the Federation as applicable.”

He also argued that it is not right as directed in Paragraphs 5 (iii) and (iv) of the FIRS press statement on Clarification on Administration of Stamp Duties in Nigeria, which claims that FIRS is vested with powers to collect stamp duties on all banking transactions.

He described it as a very wrong clarification not supported by applicable laws on the issue.

He, therefore, urged Adedeji to withdraw the perceived FIRS statement on administration of stamp duties in Nigeria, dated July 7, 2020 and replace it with a version that is consistent with the provisions of the 1999 Constitution.

Ubani also said that the National Assembly has the exclusive powers in respect of all subject matters in the Exclusive Legislative List under Section 4 (2) of the 1999 Constitution, as altered.

According to him, in this regard, Item 59 of the Exclusive Legislative List vests the National Assembly with power in respect of “taxation of incomes, profits and capital gains, except as otherwise provided by this Constitution”, making these taxes “Federal Taxes.”

He further said the National Assembly is vested with powers to make laws on any matter included in the Concurrent Legislative List to the exclusion of the Houses of Assembly of states.