The Committee of E-Business Industry Heads (CeBIH) has stressed the need to leverage Artificial Intelligence (AI) to thwart criminal activities and combat cyber threats thereby ensuring safety in digital payment.

The body noted that Al’s capacity for real-time threat detection, predictive analytics, and adaptive response mechanisms, heralds a new frontier in cyber security, offering unparalleled capabilities in fortifying defenses and mitigating risks.

This was disclosed at the 2024 Quarter II Industry Forum organised by the CeBIH, themed: ‘Cybercrime: Enhancing Consumer Trust and Security with Artificial Intelligence’, held in Lagos.

Speaking, CeBIH Chairman, Celestina Appeal, who bemoaned the role cybercrime had played in endangering lives and businesses, thereby rendering many to depression, noted that all hands must be on deck to nip it in the bud.

She said: “In an era marked by unprecedented technological advancement, the digital landscape presents boundless opportunities for innovations through dynamism.

“However, these opportunities come with inherent risks, and the most prevalent of them being the pervasive threat of cybercrime. Today, we confront this ugly threat head-on, recognising the utmost importance of maintaining consumer trust and security, in the digital space, threatened by uncertainties.

“As we navigate the complexities of safeguarding sensitive data and fortifying digital infrastructure, artificial intelligence emerges as a powerful tool in our quest to combat cyber threats.”

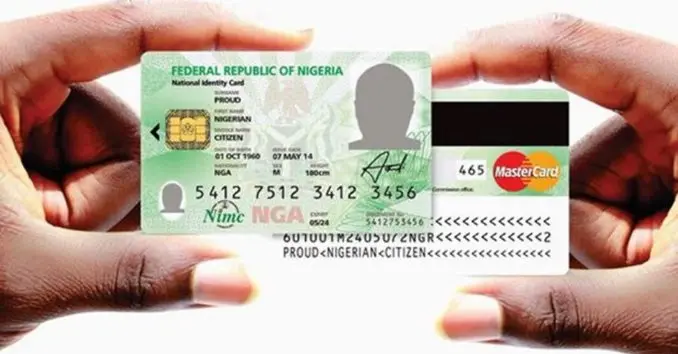

Vice President and Cybersecurity Consulting Practice Lead at Mastercard, Amit Mehta, emphasised the critical role of AI in enhancing consumer trust in digital banking.

“While new technologies are evolving rapidly, our focus should be on their impact on consumer experience. AI is a key innovation that digital banking cannot afford to ignore, as it has the potential to revolutionise the financial services ecosystem.”

CEO of Autogon AI, Obi Ebuka, demonstrated how AI can transform cyber security practices, offering real-time threat detection and adaptive security measures that traditional methods cannot match.

According to him, “AI-driven systems can analyze vast amounts of data quickly, identifying unusual patterns and potential threats before they can cause harm.”

General Manager of Lagos State Consumer Protection Agency (LASCOPA), Afolabi Solebo, highlighted the increasing sophistication of cyber threats and called for innovative solutions to protect and enhance consumers’ confidence in bank transactions.

He stressed the critical role of AI in enhancing consumer trust in digital banking and cited successful case studies where AI has been deployed to protect consumers.

The stakeholders agreed that AI is a powerful tool in the mission to protect consumers and promote trust in digital banking.They emphasised the importance of transparency, education, and innovation in building consumer confidence in AI-driven security solutions.