• Rate hike lazy approach to fixing crisis, experts insist

• Rate hike lazy approach to fixing crisis, experts insist

• Inventory may continue to pile up

• Yusuf, Akpan, others kick against MPR hike fixation

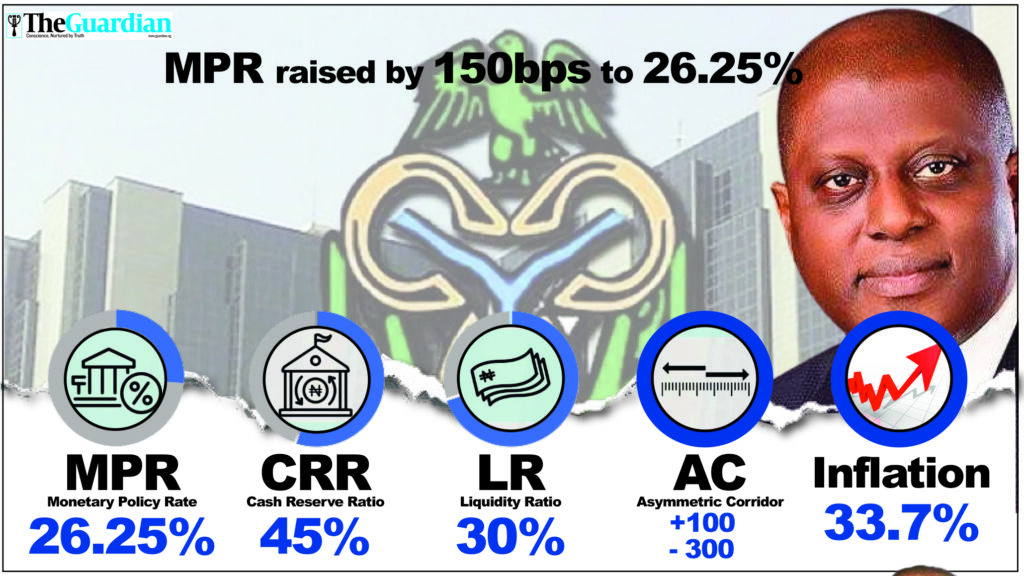

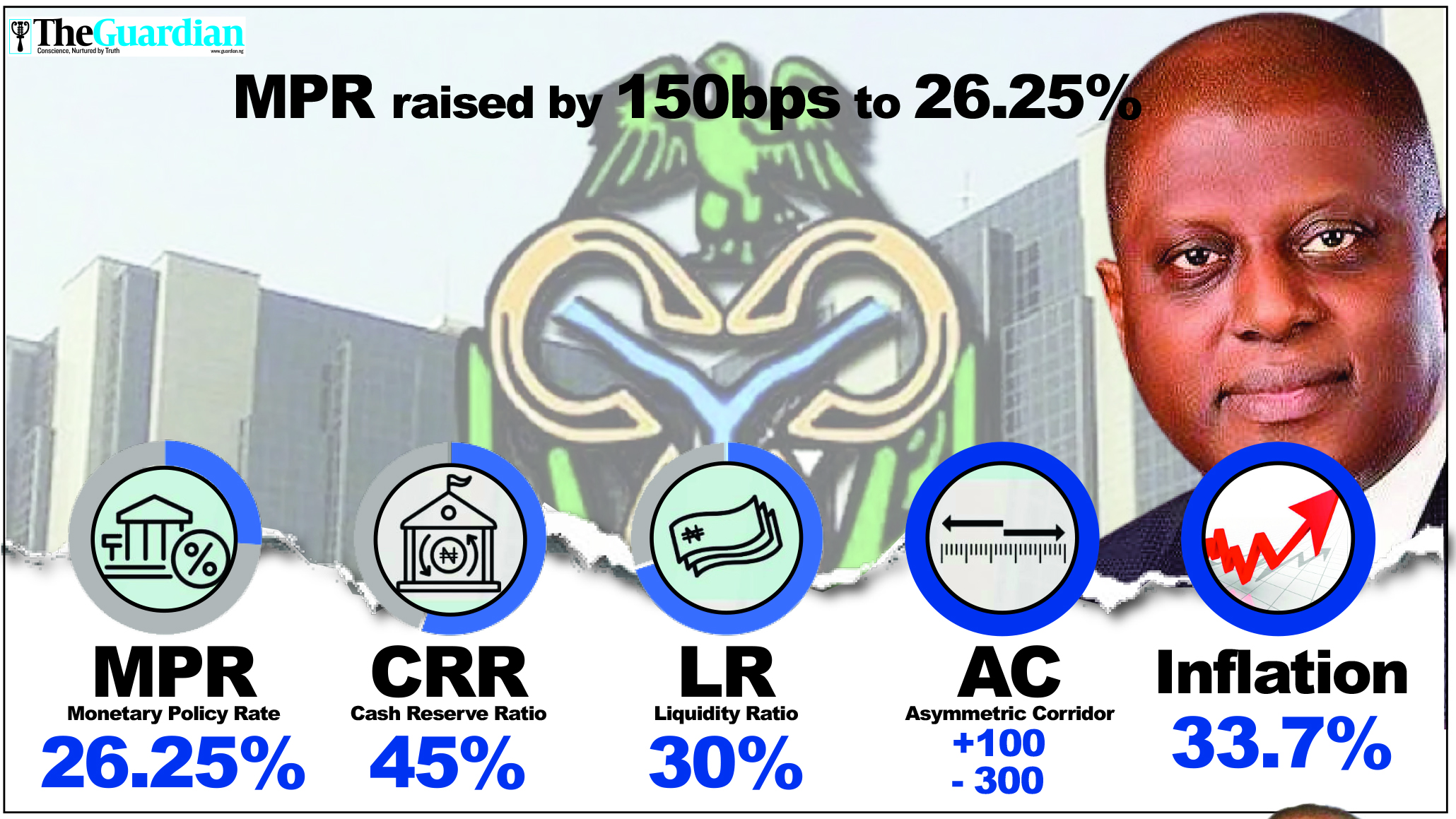

Raising the monetary policy rate by yet another 150 basis points (bps) suggests the Central Bank of Nigeria (CBN)’s appetite for short-term foreign exchange (FX) inflow is far from abating.

The announcement by the CBN governor, Yemi Cardoso, at the end of the Monetary Policy Committee (MPC) meeting, yesterday, is being interpreted as an indication of continued desperation for hot money for a quick fix for the FX crisis.

Economists warned that the preference comes at a huge cost as the authority continues to starve the real sector of much-needed funding and stifle local investments.

The experts admit that the foreign portfolio investments (FPIs) accruing from the sale of treasury bills should help stabilise the naira and lead to lower inflationary pressure.

On the flip side, this raise will further push the cost of borrowing up and production costs.

It is expected that there will be more non-performing loans that will lead to a risk of loan default which may undermine the stability of the banks.

Some analysts said the government is lazy, saying the business community is being punished because the government has refused to imbibe the idea of fiscal responsibility.

Cardoso has defended the economic choice, stressing the importance of price stability in growing a sustainable economy.

He said: “Then the bigger issue, which is the issue of confidence in the market, because at the end of the day, believe me, if there is no confidence in the market, then we have a problem.

“From every indication we have, from our dialogue with foreign investors, we have a pretty good feel of what the requirements are and what they look for. The distortions that we all know about, which over time, have resulted in a multiplicity of different circulars to address certain things, have also helped in no small measure to, as we remove that, so the confidence has also come back.”

While he agreed that headline inflation may seem to be moderating, food inflation has remained a challenge, saying: “When you go down to the specifics in terms of food, in terms of core, in terms of headline inflation, you see that it is moderating and decelerating in increment…”

The apex bank chief insisted that inflation slowing down is an indication that the tools the CBN is adopting are working.

His words: “I believe very strongly that the tools that the central bank is using are working. Now, I have said several times that there is no magic wand. These are things that need to take their own time. They pass through and the effect of the measures in advanced countries, in developing countries, they do take time. I am confident and the figures show it themselves that we are beginning to get some relief. And I think that in another couple of months, we will see more positive outcomes from what the central bank has been doing.”

Reacting to the continued hike, the Chief Executive Officer of the Centre for the Promotion of Private Enterprise (CPPE), Muda Yusuf, said he expected the CBN to hold off the rate.

His reasons, he said: “My prayer was for the MPC to pause the rate hikes for several reasons. First, previous rate hikes have been quite aggressive, hurting output and real sector investments. Most economic operators with credit exposures to the banks have not recovered from previous hikes. Interest rates were already around the 30 per cent threshold.

“Secondly, the extant CRR of 45 per cent has profound liquidity effects on the financial system. Both measures have dampening effects on financial intermediation, which is the primary role of banks in an economy.

Thirdly, the monetary policy transmission channels are still very weak, given the level of financial inclusion in the economy. This limits the prospects of monetary policy effectiveness.”

He stressed that the new rate hike is an additional cross to be borne by investors who have exposures to bank credit facilities.

“Naturally, a rigid monetarist disposition by the Central Bank is expected. But we need to reckon with the costs to the economy. Hopefully, with the positive outlook for domestic refining of petroleum products, we may begin to see a moderation in energy costs and a pass-through effect on the general price level. This is one silver lining that is on the horizon at the moment. Necessary fiscal policy support is urgently needed to compensate for the adverse impact of extreme monetarism on the economy,” he said.

An economist, Kelvin Emmanuel, said the message the monetary policy committee wants to send is that the fiscal authorities are willing to sacrifice growth for taming inflation.

Sounding a note of caution, Emmanuel observed that it is important to understand that keeping CRR at 45 per cent in the face of rising non-performing loans on the balance sheet of banks, and not linking the cash reserve ratio to loan deposit ratio ratios of banks will mean that SMEs will continue to face roadblocks of single obligor limit.

The economist also berated the Minister of Finance and Coordinating Minister of the Economy, Wale Edun, for doing such a poor job, especially on the urgent need to push for the amendment of the tax code, the Public Procurement Act to reduce procurement fraud, implementing the Stephen Oronsaye report to reduce the 262 parastatals.

He argued that the Minister has failed to tap on central bank overdrafts to finance budget deficits with a revenue performance that fell short more than 80 per cent in Q1 and ramping up on backward integration for components for blending fertiliser, providing feedstock for domestic refining to reduce the $2.4 billion monthly that is funding the nation’s energy basket.

According to him, it is difficult to understand the Federal Government’s delay in transferring NNPCL to an asset manager as a beneficial owner to change the structure for ownership, and financing of key oil and gas assets as well as collapsing the revenue collection function of 62 MDAs including the Nigeria Customs Service – whose job should be that of trade facilitation.

He then added: “As I have said times and again, the Federal Government cannot rely on the Central Bank alone to fight inflation. The management of the apex bank has improved remarkably since last year, but the fiscal authorities are letting down the MPC.”

More experts differ with the CBN governor, especially on what he called the ‘gains of the previous tightening’.

A financial analyst, Abubakar Umar, insisted that given the dilemma confronting the CBN, raising the rate is difficult and business will suffer, saying reducing it is not an option.

A fiscal governance expert and Lead Director of the Centre for Social Justice (CSJ), Eze Onyekpere, in a message he sent to our correspondent, said from the foregoing, the MPC under Cardoso has run out of ideas as the claim that earlier tightening is working is not true.

He said there are fundamental risks to the economy imposed by this tightening stance.

“Government debts at the federal and state levels have become more expensive to service as bonds, treasury bills and loans from banks will attract rates benchmarked on the MPR.

“Access to credit for the real sector of the economy has been constrained by excessively high interest rates already more than 30 per cent. Of course, manufacturers and service providers will transfer their costs to customers, the ordinary Nigerians whose purchasing power has been decimated by the administration’s economic policies,” he said.

Onyekpere said the task of maintaining price stability has been abandoned as the increase in cost of funds, increased electricity tariff and the inclement environment for doing business combine to further increase the price of goods and services.

“This is a cruel joke gone too far off the mark. The autonomy of the CBN and its MPC was not granted by law to impose severe hardship on the Nigerian people. The CBN, MPC and the administration know what to do to restore the value of the naira, reduce inflation and get the economy back to work. Even if the MPR were to be doubled today, inflation would still be escalating and the naira would still be depreciating,” he said.

Also reacting, Prof. Jonathan Aremu, an economist, said this is a trying time for Nigerians.

He said the CBN might be seeing other things the public is not seeing, adding that it could be to discourage those who because of the high exchange rate, go and borrow money to buy forex, knowing that when they sell it back, they will make huge profits.

He explained: “My position is that it is going to hurt those who borrow for productive purposes,” he said, adding that “if they borrow at high interest rates, they will also fix their prices in such a way that they will be able to make a profit. The products will be expensive, that brings inflation and we are back to square one.”

President of the Lagos State Chapter of the Association of Certified Fraud Examiners (ACFE), Dr Titilayo Fowokan, said with the present state of the economy, apart from just monetary authority fighting inflation, fiscal policymakers should review government expenditure patterns to cut down on government spending in all aspects, especially on external borrowing and recurrent overheads.

“They should consider policies that will boost the productive capacity of the country, be it at corporate or individual levels,” she said.

She added: “Fiscal policymakers should consider time-bound tax incentives that encourage industrialisation, create employment, production of locally-made public goods, facilitate exports, encourage investment in green energy, and other potential economic resources that will alleviate poverty and foster steady revenue generation at both national and sub-national levels.”

Prof. Uche Uwaleje, an expert in capital markets, said the MPC had raised the rate by 400 basis points in February and added another 200 in March in line with the tightening stance of the CBN.

Uwaleke said over-reliance on the MPR as a tool to tame inflation does not appear to be making any meaningful impact due to the significant non-monetary factors driving inflation in Nigeria such as high cost of energy, transport as well as insecurity in the food-belt regions of the country.

“Inflation rose year on year in April despite the aggressive 600 basis points hike in the MPR between February and March and the exchange rate has yet to stabilize. Again, following the IMF-World Bank spring meetings last April, the CBN has received praise from the IMF and some global rating agencies such as Fitch for its monetary policy tightening stance. MPC will be mindful of that in order not to create a different impression especially when the Bretton Woods Institutions are urging the Bank to do more,” he said.

The professor of capital market stressed the need to apply hand brake at this point as the aggressive policy rate hike is taking a toll on output.

On his part, Prof. Akpan Ekpo Akpan explained that so long as production is low due to insecurity, the inflation rate will continue to skyrocket and cannot easily be tamed by a mere increase in the MPR.

Akpan stressed: “There is no amount of increase in the interest rate that can tackle the high cost of inflation, we must look inwards, produce for consumption and for exports to earn foreign exchange, the government should provide adequate power to stimulate production and growth, we must cut the cost of governance and reduce borrow.”

The committee, apart from raising the rate by 150 basis points to 26.25 per cent from 24.75 per cent also retained the asymmetric corridor around the MPR to +100/-300 basis points, retained the Cash Reserve Ratio of Deposit Money Banks at 45 per cent while retaining the liquidity ratio at 30 per cent.