African business leaders and global institutional investors have signed subscription agreements and letters of intent in preparation for the first close of the Africa50 Infrastructure Acceleration Fund (IAF) to catalyse investment flows in development of critical infrastructure across the continent.

The stakeholders comprise 18 African nations, including sovereign wealth funds, development finance institutions (DFIs), banks, pension funds, asset managers and retirement agencies and two international institutional investors, with other additional entities expected to join the first close.

The signing ceremony, which took place at the Infra for Africa Forum and general stakeholders meeting in Lome, is the first for an infrastructure fund in Africa, and demonstrates the continent’s determination to be in the driver seat, while forging global partnerships to stimulate economic growth.

Africa50 is an infrastructure investment platform that contributes to the continent’s growth by developing and investing in bankable projects, catalysing public sector capital and mobilising private sector funding, with differentiated financial returns and impact.

Its IAF represents a pivotal vehicle that aims to bridge the financing gap in Africa’s infrastructure landscape. The commitments from the institutional investors are expected to unlock transformative infrastructure projects across various sectors, including energy, transportation, telecommunications and water.

Speaking at the signing, President of the African Development Bank, Dr. Akinwumi Adesina submitted: “I strongly believe that for African institutional investors, this is the time to change the investment narrative on Africa. It is remarkable and unprecedented to have 17 African institutions participating in such a transforming initiative to invest in an African infrastructure fund. With the Fund, we are positioning the Africa50 Group to play a lead role in helping to tap into the more than $98 trillion of global assets under management.”

Adesina said Africa would need $277 billion yearly through 2030 to achieve its climate financing targets and drive green growth, especially the continent’s nationally determined contributions.

He said: “A lot more resources will be needed to support Africa’s accelerated development, green growth and regional integration, especially on infrastructure. Africa50 is doing amazing work as an institution, developing projects to bankability and financing projects. At the heart of our work is to help close the $68 to $108 billion yearly infrastructure-financing gap for Africa. In the past six years of operations, Africa50 has garnered support across Africa, and today has 31 African countries as shareholders and three African institutional investors. With a total subscribed capital of just under $1 billion, it has invested in critical infrastructure, with a total value of over $6.6 billion.”

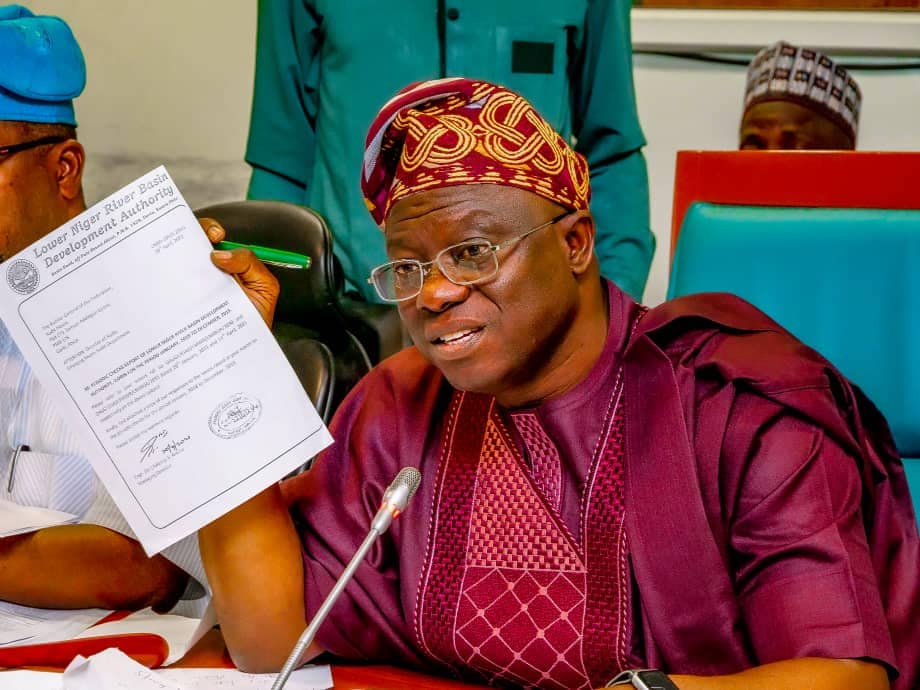

Chief Executive Officer and Managing Director, Nigeria Sovereign Wealth Fund, Aminu Umar-Sadiq noted: “NSIA’s priority focus on sustainable infrastructure aligns with the Fund’s vision to positively contribute to economic growth and development of the continent, including investing profitably, responsibly and sustainably. The NSIA has a clear mandate to bring development to Nigeria and by extension, the continent, and our investment in the Africa50 IAF is an opportunity to expand our development impact in Africa, while generating attractive financial returns.”

Chief Executive Officer of Arab Bank for Economic Development in Africa (BADEA), Dr. Sidi Ould Tah, noted: “BADEA’s investments are meant to have a meaningful impact in the economies of its partner countries across various sectors. Infrastructure has always been the main area of focus for BADEA. Africa is a region with tremendous potential and a key priority for us, we are therefore pleased to join a credible partner like Africa50 in this groundbreaking partnership, to scale up infrastructure development on the continent.”

On his part, the Chief Executive Officer of Africa50, Alain Ebobissé, stressed: “Securing commitments from such prominent African institutional investors marks the beginning of a new era of collaboration and investment in Africa’s infrastructure sector. This African-led initiative is a powerful testament to our collective vision of transforming the continent’s infrastructure landscape. Together, we will catalyse African financial resources to build the foundation for a brighter future, one that drives prosperity, job creation, and sustainable development for all Africans.”