MTN plans $1.8b data, fintech investments

Broadband connections in Nigeria dropped by 1.18 cent in January, moving from 43.71 per cent in December 2023 to 42.53 per cent in the first 31 days of the year.

Subscription statistics from the Nigerian Communications Commission (NCC), the January edition, released at the weekend, showed that the number of users also plunged by 2.56 million. It decreased from 94.7 million to 92.1 million within the period under review.

The drop in broadband connections in the country has further slashed the attainment of the 70 per cent broadband target set for 2025. As it is, Nigeria is 27.47 percent farther from next year’s target as enshrined in the New National Broadband Plan 2020 to 2025.

Interestingly, during the period under review, data consumption rose. Nigeria consumed 721,255 terabytes in January as against last December’s 721,522 terabytes consumption.

MEANWHILE, telecommunications group, MTN planned to invest an additional R39 billion (approximately $1.8 billion) to boost its data and fintech services offerings across Africa this year.

This comes as the group’s active fintech users rose to 72.5 million at the end of 2023. According to the company’s 2023 audited financial result released on Monday, the volume of fintech transactions increased by around a third to 17.6 billion, with the value of transactions across the fintech platform up at $ 272 billion.

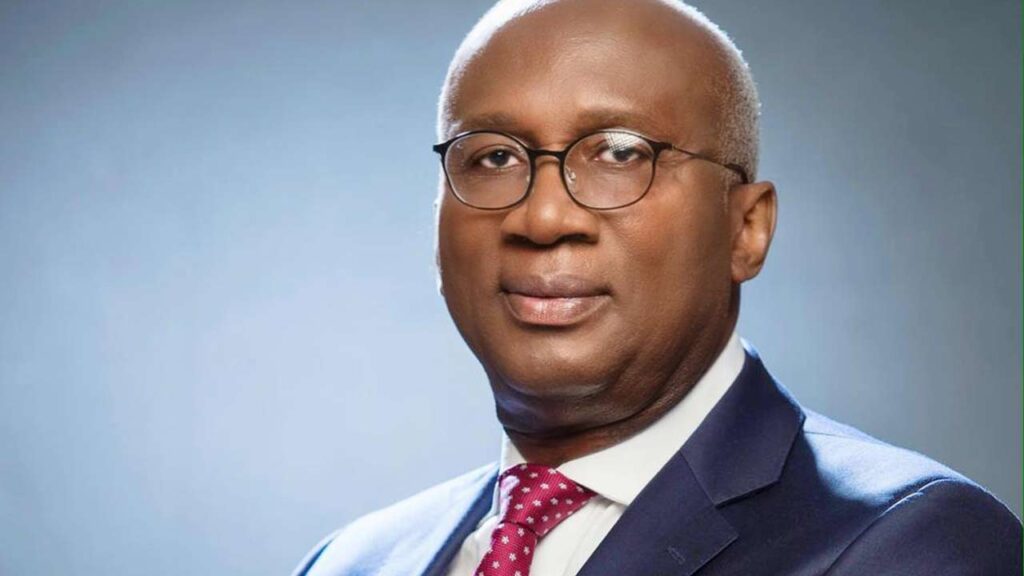

While acknowledging the macro-economic conditions in some of its operating environments, especially, forex volatility in Nigeria, MTN Group President and CEO Ralph Mupita, said: “We are anticipating that the macro conditions in our trading environment will persist in 2024, with naira volatility and elevated inflation the key challenges we will need to navigate.

“MTN plans to invest R35-39 billion in 2024 to position the company to capture the structural demand for data and fintech services across Africa.”

“We maintain our overall medium-term guidance framework, however simplifying our objective for fintech. MTN was encouraged by the outlook for the fintech business, given the solid growth in advanced services.

“The partnership with Mastercard positions the business well to scale faster and we are excited about the commercial launches of card issuance, acceptance, and remittances across the footprint.

On the need for further investment in data, MTN Group said it recorded a sustained high demand for data and fintech services in 2023. The Group’s active data subscribers increased by more than nine per cent to 150 million – half the total subscriber base.

The Group’s active Mobile Money (MoMo) users also increased by five per cent to 72.5 million, impacted by a strategic shift in focus to wallet customers in Nigeria and base clean-ups in Côte d’Ivoire and South Africa.As of December 2023, MTN Group’s total subscribers increased to 295 million across its markets.