.Commends intervention of banks’ CEOs

The Association of Licensed Telecoms Operators of Nigeria (ALTON) has made it clear that there won’t be any room for debt forgiveness as regards the N200 billion Unstructured Supplementary Service Data (USSD) debts owed by Deposit Money Banks (DMBs).

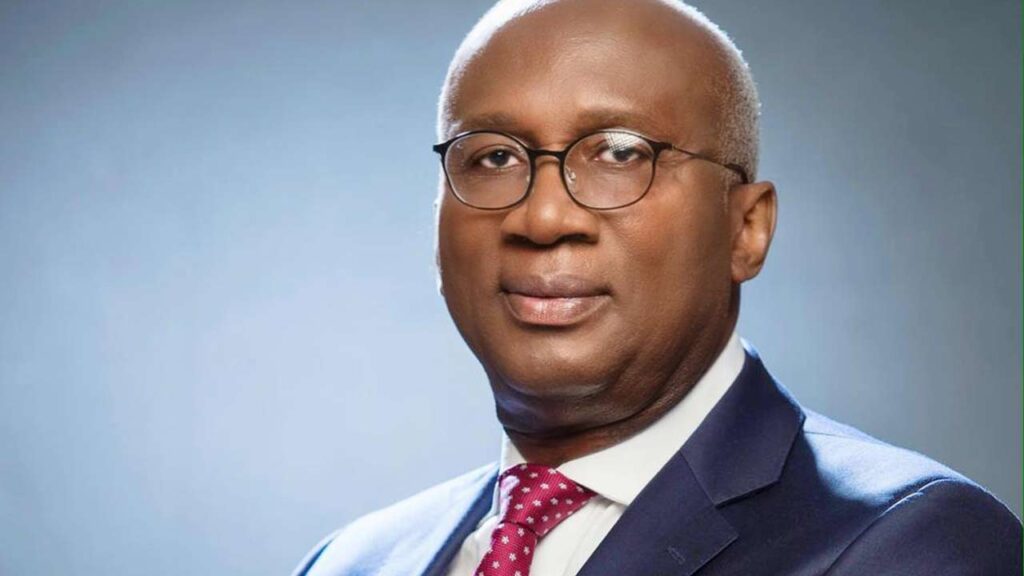

The Chairman of ALTON, Gbenga Adebayo, speaking with The Guardian, said that there had been intervention from the Committee of Banks’ CEOs on the matter, saying parties involved in the matter are now more aware of the implications of the issue.

Adebayo said though they are not there in terms of having lasting solutions on the matter, discussions are very much ongoing.

“Parties involved in the matter have agreed that it is a matter that must be resolved. I think compared to where we were on the matter at the beginning of 2023, we are better off today and hope that we can have improvement in the recovery process. But certainly, we are having some movements on the matter. We are not yet there, but latest developments showed that there is hope that the matter will soon be resolved.

Commending the efforts of the Committee of Banks’ CEOs on the matter, the ALTON Chairman said the current chairman of the body, who is the CEO of Zenith Bank, has done well on the matter.

“He has done well. We think that during his time, we have had more positive moments in this regard compared to what we had with his predecessor. We must also recognize his role and hope that parties will cooperate with him and that the spirit of progress we have seen on this matter will bring better results.

“What we will do or not do, I think it is too early to say, but certainly, the light is coming on the fact that there is a commitment and willingness on both parties to resolve the matter. But I must add that it has never been part of the conversation that there would be debt forgiveness and it will not be part of it. If we get to the point that every avenue or mechanism of recovery fails, we will have to embark on the instrument of collection and this can be anything.

“It can be withdrawal of services; it can be going into a dispute resolution process and all of that. But it is not in the discussion that this debt will be forgiven. It is money(s) for services that have been rendered. We believe strongly that these monies have been collected by DMBs. We believe that subscribers have been debited huge sums of money from their accounts. We think it is only honourable if services provided to you for which you have received economic benefits, you should at least pay those who enabled the services.”

According to him, the banks are no longer building brick-and-mortar stores but rely on digital platforms to carry out services and they are benefitting hugely from USSD, which is positively affecting their bottom line.

“The debt will need to be paid. It is not in any conversation that it will be forgiven. We are not unaware or ungrateful for the current efforts of the head of the Committee of Banks CEOs. He has done well on the matter. He’s a man we respect a lot and believe that the efforts he’s making, we shall get to the end of this matter on time,” Adebayo stated.

The Guardian noted that this fracas between the telcos and DMBs entered its fifth year in 2024 without a major truce. This challenge implies that the Federal Government’s 95 per cent financial inclusion target of 2024 may not be realised after all.

Recall that the Chief Executive Officer of Guaranty Trust Holding Company Plc, Segun Agbaje, described USSD as a clumsy technology, arguing that the only way to actualise financial inclusion in Nigeria is to drastically reduce the cost of data.

He stated this last May, saying the USSD is not state-of-the-art technology, which is why other developing countries like India do not use it.

Agbaje argued that the ongoing fight between banks and telcos over USSD is nothing but a distraction by telecoms firms from the real issue of high data cost. He said that Nigeria has one of the highest data costs in the world. And this is not good for financial inclusion and the overall economic development of the country.